Diving into the world of AI penny stocks can be an exciting yet challenging venture for investors. As 2025 approaches, the focus is on identifying promising AI penny stocks that could yield significant returns. Meanwhile, looking ahead to 2026, investors are keen on discovering AI stocks under $1 that might be undervalued gems. This webpage aims to educate and guide traders and investors through this dynamic sector, offering practical insights and strategies. Stay ahead in the game and make informed investment choices by exploring the top AI penny stocks and potential low-cost opportunities in the AI landscape. The top AI penny stocks are crucial to monitor for potential investment gains. Among the top AI penny stocks, understanding their potential can lead to great rewards for savvy investors.

Key Highlights

As we delve deeper into the market, it’s essential to keep track of the top AI penny stocks that show promise in innovation and growth potential.

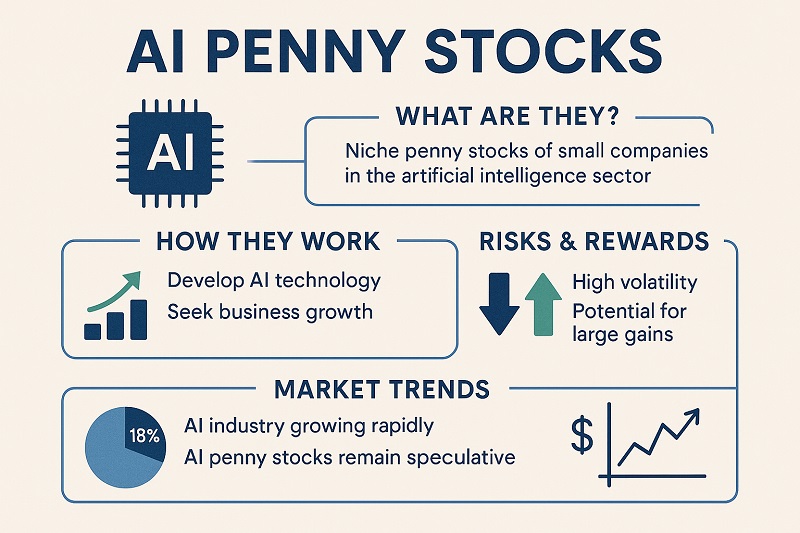

- AI penny stocks present both high risks and rewards, requiring strategic analysis for potential substantial growth in new tech domains.

- Investors should focus on AI penny stocks with innovative solutions and strong leadership, fostering dynamic growth opportunities.

- AI’s integration in industries like healthcare and finance makes penny stocks a promising arena for future investment gains.

- Regulatory changes impact AI stock prices; staying informed is crucial for navigating the volatile investment landscape.

- Balancing short-term trading with long-term investments in AI stocks can optimize portfolio growth and mitigate risks.

Understanding AI Penny Stocks

Investors should regularly review the top AI penny stocks, as these stocks often reflect the innovations in the artificial intelligence sector.

Delving into AI penny stocks offers a fascinating glimpse into the potential of these undervalued assets. As technology continues to reshape industries, artificial intelligence stands at the forefront, presenting unique opportunities and challenges for investors.

Grasping the core elements to watch out for when investing and understanding the balance of risks and rewards can transform your portfolio. As we explore what makes a good AI penny stock and weigh the potential outcomes, we offer valuable insights and practical advice to help traders and investors navigate this dynamic market landscape.

What to Look for in an AI Penny Stock

Identifying the top AI penny stocks requires keen insight into market trends and a solid understanding of technological advancements.

Venturing into AI penny stocks means examining companies on the cutting edge of technology without the hefty price tag. The key is to find companies that not only embrace innovation but also consistently demonstrate potential for explosive growth. First, scrutinize the company’s market cap. A smaller market cap may imply volatility, but also the chance for significant upswings if the company performs well. Beyond financials, check the company’s dedication to artificial intelligence. Their innovation should be evident in their commitment to research and development or partnerships with other leaders in the field. Companies that fuse AI with quantum computing or other innovative technologies often possess an edge, offering vast scalability.

Company performance data, while sometimes limited in penny stocks, can still provide insights. Investigating their past stock performance can reveal patterns and give an idea of future movements. Utilize a stock screener to filter out companies not meeting basic financial health criteria, such as liquidity and revenue consistency.

Analyzing the company’s solutions and products is crucial. The best AI penny stocks often develop niche technology solutions that meet specific market needs. For instance, a company focusing on AI for healthcare or energy efficiency could have a higher growth trajectory given current global trends.

Don’t overlook leadership and management. A strong leadership team often points to a stable company with a robust business strategy. Who’s jockeying at the helm? A well-managed venture with experienced executives in AI can weather challenges better and capitalize on emerging opportunities faster.

Lastly, peer into the company’s potential and futures. Does the business model align with where the industry is headed? Are they tapping into untapped markets, or do they hold patents that could drive future revenue? All these factors converge to make certain AI penny stocks prime candidates for investors eager for dynamic growth.

Risks and Rewards of Investing in AI Stocks

Understanding the risks and rewards associated with the top AI penny stocks can significantly affect investment strategies.

Investing in AI stocks, particularly penny stocks, comes with its risks and significant potential rewards. Understanding these can position you to make informed decisions. First, recognize the inherent volatility of penny stocks. These stocks can be subject to dramatic price swings, influenced by anything from speculative trading to market cap fluctuations.

One opportunity lies in the explosive growth potential that AI companies represent. Artificial intelligence is rapidly evolving, transforming industries like healthcare, finance, and computing. For smart traders and investors, even a modest stake in the right AI stock can yield substantial returns as the technology matures and demand rises.

However, risks abound. AI penny stocks tend to lack the comprehensive financial disclosure of larger stocks. This opaqueness can make it challenging to assess a company’s true financial health. Furthermore, the technology’s regulatory landscape is still developing. Sudden regulatory changes can impact stock performance drastically.

Stock options within AI also offer ways to manage risk. Options enable investors to speculate on price movements without the necessity of owning the stocks outright. This can provide some insulation against negative swings while capitalizing on upward trends.

With the integration of AI into industries, there’s a dual-edge regarding company stability and innovation speed. While some companies may innovate quickly, failures or public perception issues can drastically damage prospects, making diversification crucial. Engage with indices that track AI sector performance to gain broader exposure and minimize individual company risk exposure.

In the broader horizon, assess how AI stocks compare in terms of long-term performance. The potential for these stocks to outperform traditional sectors is high as AI becomes integral to virtually every aspect of industry. With careful research and strategic trading, the journey through AI stocks can yield rewards that far outweigh their risks, ensuring that your investment strategies align with anticipated technological advancements.

Current Trends in Artificial Intelligence

Artificial intelligence is undeniably shaping the economic landscape, driving remarkable growth across various sectors and redefining the future of technology investment. Trade enthusiasts and investors are keenly watching how artificial intelligence continues to evolve, particularly within penny stocks, which offer both high risk and high reward potential. From impacting the computer industry to reshaping the dynamics of cybersecurity within stock market frameworks, AI stands as a powerful force. These trends not only affect immediate market prospects but also future strategies for investing in technology-driven companies.

The Role of AI in the Future of Penny Stocks

When it comes to penny stocks, especially those in the burgeoning field of artificial intelligence, the landscape is as promising as it is volatile. AI technology is fundamentally reshaping how these companies operate, offering dynamic opportunities across industries like healthcare, finance, and even cybersecurity. Savvy investors are drawn to AI penny stocks due to their relatively low entry cost coupled with the potential for explosive growth. The defining aspect of AI in penny stocks lies in its vast scalability and application potential. For instance, companies that leverage AI to improve their trading algorithms or offer unique solutions in niche markets, such as quantum computing or edge computing, often become pioneers within their segments.

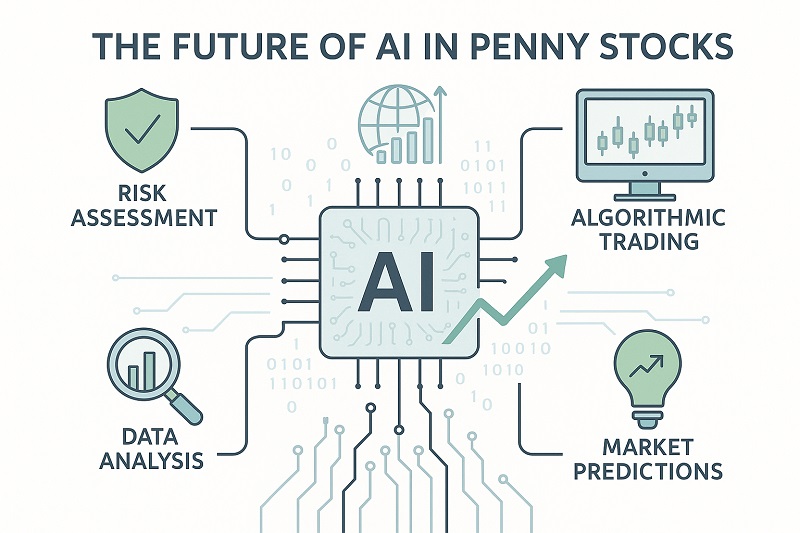

AI’s role in trading goes beyond mere operational efficiency. It’s about harnessing vast datasets to predict market sentiments and fleeting opportunities with precision, a strategy that, when correctly implemented, can yield substantial returns. The use of AI for predictive analytics in stock trading is increasingly becoming a game-changer. Companies implementing such advanced systems are setting themselves apart, making them prime candidates for savvy investors looking for under-the-radar stocks with high growth potential. Furthermore, AI enables better market screener tools, helping investors filter through companies with robust AI implementations that align with future market trends.

Investors should consider the philosophy behind a company’s AI deployment, a belief in innovation and a forward-thinking approach can often lead to groundbreaking solutions. As industries increasingly integrate AI into their operations, those penny stocks embracing this digital transformation stand a better chance of achieving exceptional market cap growth. The nascent nature of AI means there’s uncharted territory to explore, and companies that position themselves in the artificial intelligence space have the potential to leapfrog their peers. This is especially true for stocks listed on the Nasdaq, which stand at the forefront of tech innovation.

However, it’s important not to overlook the inherent risks. The potential of a company is often mirrored by its volatility. Investors need to understand this balance and prepare for swings in stock prices. According to industry analysis, staying updated on industry news and emerging AI trends can offer crucial insights that help mitigate risks associated with investing in these markets. As AI continues to redefine market dynamics, its role in penny stocks promises to offer both challenges and unprecedented opportunities for traders willing to delve into this exciting frontier.

Impact of AI on Computing Penny Industries

By focusing on the top AI penny stocks, investors can align their portfolios with the future of technology and innovation.

The computing penny stock arena is experiencing a renaissance, largely fueled by the integration of artificial intelligence across various segments. From enhancing processing capabilities to improving cybersecurity frameworks, AI is laying the groundwork for transformative changes. A key aspect of AI’s impact is its potential to revolutionize the quantum computing sector, which is in its nascent stages but holds tremendous promise for the future. The role of AI in accelerating computing processes cannot be overstated; it enables more complex computations at speeds previously unattainable, opening new doors for industries relying on massive data analytics.

The burgeoning relationship between AI and computing penny stocks is evident through the continuous developments in technology solutions these companies offer. As AI integrates deeper into product offerings, companies that adapt quickly are poised to capture substantial market share. For instance, organizations that combine AI’s analytical power with innovative computing solutions are finding unique niches, enabling them to outmaneuver less agile competitors. AI-driven technologies such as machine learning, deep learning, and neural networks are central to these efforts, allowing for real-time data processing enhancements that drive business efficiencies and market adaptability.

Investors looking at computing penny stocks should pay close attention to companies collaborating closely with giants like Nvidia and Microsoft. These collaborations often lead to breakthroughs in AI applications, with smaller companies gaining access to advanced research and extensive resources, which can significantly enhance their service delivery. Companies positioned strategically within the computing sector that leverage AI for operational advancements typically demonstrate robust futures capabilities and potential for impressive growth trajectories.

Despite these opportunities, potential investors must remain vigilant about the risks. The fast-paced nature of AI advancements can lead to substantial shifts in market dynamics, impacting stock valuation unexpectedly. The philosophy behind AI implementation can influence a company’s stability, making it crucial for investors to evaluate management teams and their adaptability to continuous technological shifts. Looking ahead, trends suggest that as AI continues to mature, the computing penny industry will become even more pivotal, challenging investors to remain informed about ongoing innovations and market strategies.

Navigating the impact of AI on computing penny stocks demands a thorough understanding of market trends and company-specific capabilities. For smart investors, there lies an untapped reservoir of potential to explore, offering the possibility of lucrative returns. By staying informed and strategically aligning investments with companies embracing AI innovations, traders position themselves to capitalize on the transformative power of artificial intelligence in the computing sector, ensuring a rewarding and enriching investment journey.

Top AI Penny Stocks to Watch in 2025

The search for the best opportunities among the top AI penny stocks is crucial for investors looking to capitalize on emerging technologies.

The allure of AI penny stocks is undeniable, especially as we look forward to 2025, a year poised for innovation and investment opportunities. Among these emerging stocks, particular companies stand out as they push the frontiers of technology with accessible stock prices. The potential for growth in top AI penny stocks makes them an attractive consideration for traders and investors aiming to capitalize on the rapidly evolving market landscape. This exploration focuses on standout AI penny stocks under $1, and the essential market factors shaping their prices and potential growth.

In summary, the top AI penny stocks not only represent a unique investment opportunity but also reflect the broader advancements in AI technology. Recognizing the potential within these stocks is essential for any forward-thinking investor.

Investors should keep a close watch on the top AI penny stocks as they can offer substantial returns as the market evolves. With the right strategy, picking the top AI penny stocks could lead to impressive financial outcomes in the coming years.

The top AI penny stocks provide unique opportunities for investors focusing on the emerging trends in artificial intelligence. As sectors like healthcare and finance embrace AI, the top AI penny stocks are positioned to benefit significantly from these shifts.

Standout AI Penny Stock Under $1

Diving into AI penny stocks can sometimes feel like searching for a needle in a haystack, especially when you’re looking at options priced under $1. Yet, the rewards can be substantial for those who manage to pick the right company. What sets apart a standout AI penny stock is not just the price tag, but the company’s potential for growth and innovation in artificial intelligence. For savvy investors, the challenge is in identifying which of these low-priced stocks could become tomorrow’s industry leaders without breaking the bank today.

Recognizing standout companies among the top AI penny stocks can lead to rewarding investment choices.

One important factor to consider is the company’s market cap. Typically, a smaller market cap suggests volatility, often seen in penny stocks, but it also implies the potential for significant returns as the company scales its operations. This is crucial in the AI sector, where businesses might be small today but have vast growth opportunities thanks to technological advancements.

Overall, the top AI penny stocks are essential to consider for investors looking to enter a fast-paced market. Understanding the innovations driving these stocks will help in making prudent investment decisions.

In recent years, several AI penny stocks have gained attention due to their unique solutions and applications in industries like healthcare, finance, and cybersecurity. These companies often provide innovative AI-driven products that address specific, pressing needs. Stocks that successfully harness AI for pioneering solutions, such as machine learning algorithms for predictive analytics in stock trading, often show great promise.

Moreover, the leadership and management team can make a substantial difference in the performance of an AI penny stock. A robust management team with a clear vision and expertise in AI can navigate the challenges of the market effectively, ensuring the company remains on a growth trajectory. Investors need to look closely at who’s behind the company, those with a track record of leading technology firms successfully often increase investor confidence.

Another key aspect to consider is the company’s strategic partnerships with more prominent firms or academia for research and development. These partnerships can provide smaller companies with access to cutting-edge research and innovations, allowing them to punch above their weight in competitive markets.

Investors should also keep an eye on the stock’s liquidity and market presence. While a penny stock might not have the trading volumes seen in more established companies, those with increasing volumes often indicate rising investor interest. A solid presence in significant stock exchanges like NASDAQ can also provide visibility and credibility, which are critical for stock performance.

For traders, employing a comprehensive stock screener can assist in filtering out the noise and pinpointing stocks with genuine potential. Screeners can help identify critical financial health indicators within AI penny stocks you should watch in 2025, ensuring your investments are aligned with resilient and forward-looking companies.

Investors should leverage insights on the top AI penny stocks to inform their investment strategies.

To truly capitalize on emerging trends, investors must identify the top AI penny stocks that will rise as AI becomes more pervasive across industries. These stocks are often the key indicators of technological advancement.

In conclusion, while the field of AI penny stocks priced under $1 is rife with potential, identifying the true standouts requires diligent research and an eye for long-term gain. By focusing on companies demonstrating a blend of innovation, strategic growth potential, and strong management, investors can unlock significant future returns and tap into the transformative power of the AI revolution.

Key Factors Influencing AI Stock Prices

Understanding the factors that influence AI stock prices is crucial for any investor looking to capitalize on this dynamic sector. Market trends, technological advancements, and corporate strategies all play significant roles in shaping the trajectory of AI penny stocks. By delving deeper into these elements, investors and traders can better navigate the complexities of the AI stock market and enhance their trading strategies.

The first aspect to consider is market sentiment and its impact on stock performance. AI stocks, particularly penny stocks, are often driven by market speculation. News and announcements about advancements in AI technology or partnerships with major tech companies can lead to rapid changes in stock prices. Staying informed about industry news and keeping tabs on companies that frequently appear in press releases or innovation announcements can offer early indicators of potential price movements.

Another critical factor influencing AI stock prices is the underlying technology. Companies that continue to innovate and integrate AI into their operational frameworks tend to perform better in the long run. A company that consistently invests in research and development to enhance its AI capabilities is likely to experience steady growth. This often translates into stable or increasing stock prices, providing a beacon for investors tracking promising AI penny stocks.

Regulatory changes can also play a pivotal role in stock pricing. As AI technologies continue to evolve, they face various regulatory challenges, ranging from data privacy concerns to ethical use of AI. Changes in regulation can significantly impact a company’s ability to operate efficiently, thereby influencing stock prices. Investors need to monitor these developments and understand their implications on the sustainability and growth potential of their investments.

Economic indicators such as employment rates, consumer spending, and inflation can equally affect AI stock prices. A thriving economy may boost spending on technology, promoting higher stock values. Conversely, economic downturns might lead to reduced investment in AI innovations, affecting stock performance. Understanding macroeconomic trends can help investors anticipate stock market movements and adjust their strategies accordingly.

Understanding macroeconomic factors can further enhance an investor’s perspective on the top AI penny stocks.

The competitive landscape of the AI industry is another component to study. The entrance of new competitors or disruptive technologies can challenge existing market players. Companies that maintain a competitive edge through unique AI-driven solutions or patented technologies are more likely to sustain growth and profitability. Investors should seek out companies with proven competitive advantages and adaptability to industry shifts.

Finally, company-specific factors such as financial health, revenue patterns, and strategic vision contribute to determining stock prices. A comprehensive analysis of a company’s financial statements can reveal its capability to weather industry challenges and tap into growth opportunities. The management’s strategic vision and execution proficiency are vital indicators of a company’s potential to thrive in the ever-evolving AI sector.

In conclusion, while AI penny stocks offer vast opportunities for substantial returns, the associated volatility requires a strategic approach informed by market insights. By analyzing key factors such as market sentiment, regulatory changes, technological advancements, and economic conditions, traders can develop robust investment strategies that maximize potential while minimizing risks. With the proper knowledge and tools, investors can successfully navigate the landscape of AI penny stocks and seize the opportunities they present in the burgeoning field of artificial intelligence.

For those eager to explore investment avenues, focusing on the top AI penny stocks is crucial. Their potential for growth aligns with the rapid evolution of technology in the investment landscape.

Strategies for Investing in AI Stocks

Strategies for engaging with the top AI penny stocks are essential for long-term success in the investment landscape.

Exploring strategies for investing in AI stocks involves understanding the dynamic interplay of market trends, technological innovation, and strategic timing. As AI technology continues to evolve, investors must consider stock screening, investment approaches, and timing for optimal returns. The landscape of AI stocks offers numerous opportunities across penny stocks, potential breakout companies, and long-term investment prospects. Exploring how to choose AI stocks under $1 and understanding the nuances of short-term versus long-term investment strategies can empower investors to make informed decisions and maximize their portfolios in the ever-evolving AI market.

How to Choose the Best AI Stocks Under $1

Choosing the best AI stocks under $1 involves a multi-faceted approach, balancing potential risks with opportunities. For seasoned traders, scouring the markets presents an enticing challenge, as penny stocks hold significant promise despite their volatility. The key lies in finding those hidden gems on the Nasdaq or other exchanges that have the potential to redefine industry standards. One crucial step is leveraging a stock screener to sift through myriad options, identifying those companies that exhibit compelling business models and innovative solutions in AI and related technologies.

Start by examining the company’s market cap. Stocks with smaller market caps, though riskier, can present opportunities for significant gains if the company performs well. A smaller market cap often indicates a less saturated market position, allowing for a rapid increase in stock value as the firm captures more of its niche. This is especially pertinent in the AI sector, where emerging technologies such as quantum computing can exponentially increase a company’s value.

Another consideration should be the company’s dedication to AI innovations and their ongoing developments. Companies that invest heavily in their research and development are typically more likely to bring transformative products to market. This commitment can often be noted through frequent updates about their partnerships and technological advancements, a strategy that not only strengthens their market presence but also increases investor confidence. Furthermore, a company’s ability to integrate AI solutions into practical applications directly impacts its potential success, whether it’s through enhancing cybersecurity measures or optimizing trading algorithms.

Look beyond the technical solutions and assess the leadership team steering the company. Strong leadership is a bedrock of a company’s steady growth and resilience in high-risk markets like AI penny stocks. Executives with a background in successful tech ventures or deep expertise in artificial intelligence are typically more equipped to navigate economic shocks and pivot according to fluctuating market conditions.

Investing in the top AI penny stocks requires a thorough understanding of the competitive landscape and market dynamics.

Strategic collaborations and partnerships with industry giants can provide smaller AI firms with access to resources beyond their immediate reach, enabling the development of more sophisticated AI products. Such strategic associations often mean the company can leverage advanced technologies, skimming from well-established players’ research capabilities and distribution networks.

Finally, always consider the liquidity and broader market engagement. Although penny stocks may not offer substantial trading volumes, stocks listed on prominent exchanges like Nasdaq tend to exhibit increased interest from market participants. This leverage aids in achieving a wider market outreach and enhances stock credibility among investors.

In conclusion, picking the best AI stocks under $1 requires a strategic blend of in-depth research, insight into technological advancements, and an understanding of market dynamics. By focusing on potential growth avenues, scalability in AI applications, and backing by a robust management team, traders can unearth opportunities that promise rewarding returns with measured risks. Employing comprehensive analysis and thoughtful consideration can lead to identifying undervalued stocks that harness AI technology to pave new paths in their respective industries.

Long-Term vs Short-Term Investment Approaches in AI

When it comes to investing in AI stocks, understanding the difference between long-term and short-term strategies is crucial. The volatile nature of AI stocks, especially those under $1, provides a unique landscape where timing and strategy can dramatically impact investment outcomes. Short-term approaches focus on capitalizing on rapid market shifts and price volatility, ideal for traders who thrive in dynamic environments. In contrast, long-term investing in AI involves patience, betting on the steady maturation of AI technologies that promise future growth.

Short-term trading appeals to investors who can dedicate time to monitor market indices actively and leverage means like AI-driven screener tools. These tools detect momentary trends and price movements, providing traders with data essential for making informed decisions quickly. The essence of short-term trading in AI stocks lies in capitalizing on speculative events, such as exciting product launches or new partnership announcements that can momentarily spike stock prices. Thus, staying informed about the latest AI advancements and company news is imperative for short-term traders.

Short-term and long-term strategies can both play a role in navigating the landscape of the top AI penny stocks.

Conversely, the long-term approach is built around the belief in the continued growth and integration of artificial intelligence within various industries. This strategy often requires less day-to-day monitoring, focusing instead on a company’s fundamental growth prospects over time. Investors using this strategy usually conduct a thorough evaluation of a company’s long-term vision, its commitment to research and development, and its ability to sustainably innovate and scale its solutions. In the AI context, companies that consistently exhibit strong performance metrics and evolutionary strategies are often preferred for long-term holds.

Analyzing a company’s historical performance data and understanding its future roadmaps can reveal opportunities poised to benefit from AI’s transformative potential. Industries like healthcare, finance, and IoT often witness companies leveraging AI to drive substantial efficiency improvements and cost reductions, offering compelling cases for long-term investments. Investors should look at AI stocks’ capability to withstand economic shifts and capture emerging AI trends, which naturally contributes to sustaining their valuation over extended periods.

It’s essential to consider how AI stocks fit within broader economic and technology trends for long-term investments. The burgeoning impact of AI on global industries signifies a tremendous opportunity if invested wisely. Economic indicators, societal changes, regulatory developments, and a company’s technological adaptability play significant roles in shaping long-term stock performance. This approach minimizes the need for reactive trading strategies by focusing on fundamental business strength and future potential.

Balancing short-term trading with long-term investment strategies can provide flexibility, allowing investors to seize immediate opportunities while building towards sustained growth. Diversifying portfolios with a mix of both approaches could mitigate risks, as profits from short-term trades might offset fluctuations in long-term holdings. This balanced perspective leverages AI’s dynamic market positioning to benefit from quick gains while allowing long-term investments to mature steadily in value.

Ultimately, whether opting for an agile short-term approach or a steady long-term strategy, the key to navigating AI stock investments lies in continuous learning and adapting. As AI technology evolves, maintaining awareness of market trends and technological innovation remains essential. By tailoring investment methods according to individual risk tolerance and investment goals, traders and investors can effectively harness AI’s potential, ensuring a robust and rewarding investment journey.

As we navigate the financial landscape in 2025 and 2026, identifying the right AI penny stocks and those under $1 can unlock significant investment potential. With AI technologies continuously evolving, savvy investors should remain vigilant, assessing companies’ growth prospects, innovation, and market impact. Staying informed and leveraging comprehensive market analysis can lead to more strategic decisions. Whether you’re a seasoned investor or a curious beginner, these stock picks offer a promising pathway for diversification and growth in your portfolio. Embrace the future of technology-driven investments and capitalize on AI’s transformative market opportunities.

Identifying the top AI penny stocks helps investors position themselves advantageously in a rapidly changing market.

FAQs: Top AI Penny Stocks: AI Stocks Under $1 for 2026

What are AI penny stocks and why should investors consider them?

AI penny stocks are low-priced stocks of companies that focus on artificial intelligence technologies. They are considered by investors because they offer the potential for explosive growth due to the evolving nature of AI and its increasing integration across various industries.

What factors should investors analyze when selecting AI penny stocks?

Investors should examine market cap, a company’s commitment to AI innovations, management strength, strategic partnerships, and the company’s potential in tapping into current and future market trends.

How do market sentiment and regulations influence AI stock prices?

Market sentiment impacts AI stock prices through speculation and reactions to announcements, while changes in regulations can affect operational efficiency and market perception, causing price fluctuations.

What is the difference between short-term and long-term investment strategies for AI stocks?

Short-term strategies aim to take advantage of rapid price changes and market volatility, while long-term strategies focus on the company’s potential growth over time, capitalizing on the sustained integration and advancements in AI technologies.

How can investors identify promising AI penny stocks under $1?

Investors can use stock screeners to filter for stocks with strong business models and innovation in AI technologies. Key elements include evaluating the company’s market cap, technological dedication, leadership, strategic partnerships, and liquidity.