As the artificial intelligence sector continues to revolutionize industries, finding affordable entry points in promising AI stocks is a must for savvy investors. Our “Top Cheap AI Stocks 2026” guide is your go-to resource for discovering the best AI stocks to buy now. Get ahead of the trends by exploring companies poised for growth at accessible prices. From innovative startups to tech giants expanding their AI capabilities, our analysis of the Top Cheap AI Stocks will empower you with actionable insights to make informed decisions. Stay ahead of the competition and enhance your portfolio’s potential with these AI investment opportunities.

Key Highlights

Explore the Top Cheap AI Stocks that are emerging as leaders in the market.

- AI stocks in 2026 offer significant revenue growth driven by advancements in AI technologies.

- Investors should monitor AI trends, such as natural language processing and AI-driven cybersecurity, for lucrative opportunities.

- Key stock analysis factors include technological innovations, market positioning, and forward earnings estimates.

- Technical analysis helps predict AI stock market trends, complementing fundamental analysis for investment strategies.

- Diversification across sectors like healthcare and finance is crucial to balancing risk and maximizing growth in AI investments.

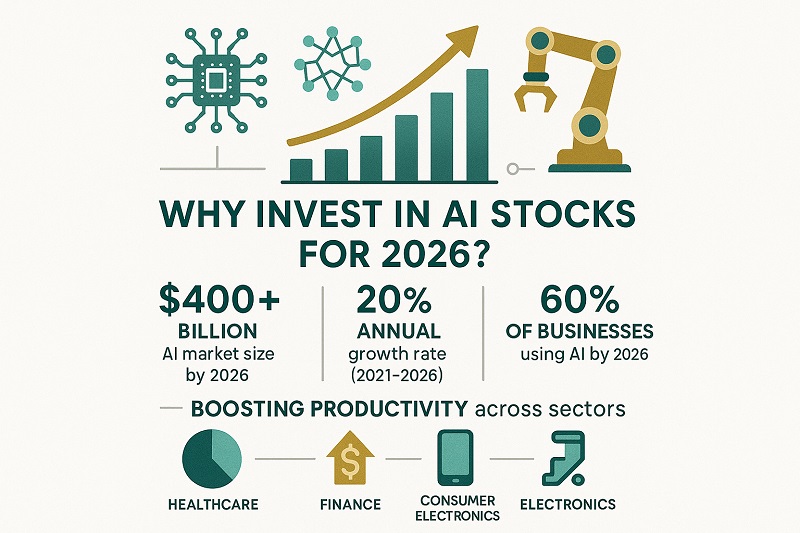

Why Invest in AI Stocks for 2026?

Top Cheap AI Stocks to Consider

Diving into the world of AI stocks in 2026 presents a golden opportunity for investors aiming to ride the wave of technological advancement. This market’s potential for revenue growth is immense, driven by the relentless evolution of artificial intelligence technologies. As AI continues to transform industries, understanding its market cap growth prospects becomes crucial. Investors are keenly focused on companies that harness AI’s capabilities, anticipating not just financial gain but also significant technological progress.

Investors looking for the Top Cheap AI Stocks should consider companies that effectively utilize their resources for maximum growth.

By exploring future trends, traders can position themselves strategically, ensuring they’re aligned with the burgeoning growth that AI promises.

Understanding the Potential for Revenue Growth

When it comes to cheap AI stocks, the potential for revenue growth is something every savvy investor should closely examine. These companies are at the forefront of technological innovation, consistently pushing the boundaries of what’s possible with artificial intelligence. In the stock market, such AI companies are increasingly showing promising market cap growth, driven by their ability to monetize AI technologies efficiently.

When evaluating the Top Cheap AI Stocks, it’s crucial to analyze their market positions.

Investors are keen on understanding which companies have the strongest tools to leverage this revenue potential. These organizations are deploying AI in sectors such as healthcare, finance, and energy, offering innovative solutions that not only enhance efficiency but also reduce costs. By effectively tapping into these sectors, AI stocks have demonstrated robust revenue growth, a key driver for stock market success.

Market analysts predict a consistent upward trajectory for AI-driven enterprises, thanks to their sustained investments in research and development. This investment strategy is not just boosting their current market position but is also setting the stage for long-term growth. Companies that focus on machine learning, big data analytics, and neural networks are particularly poised for exceptional growth. It’s this growth potential that makes AI stocks so appealing.

The potential for the Top Cheap AI Stocks to disrupt the market is substantial.

Many investors see the year 2026 as a crucial point, where AI technology will become further ingrained into everyday business processes, resulting in exponential growth in specific companies’ revenues. Hence, acquiring AI stocks now, when they are relatively cheap, could lead to substantial returns, as market demand surges and companies capitalize on their AI investments. It is this foresight and strategic alignment with AI trends that could define winning portfolios in the coming years. The allure of AI, backed by tangible revenue growth, makes it an enticing field for those looking to expand their market reach and investment potential.

Exploring the Future Trends in AI Technologies

Looking ahead, the Top Cheap AI Stocks will be central to discussions about market growth.

The future trends in AI technologies are captivating for anyone looking to invest in AI stocks. As the technology rapidly evolves, staying ahead involves understanding how these trends influence market dynamics. In 2026, we anticipate significant advancements in natural language processing, autonomous vehicles, and AI-driven cybersecurity solutions. These areas are not only driving innovation but also creating expansive revenue streams for companies that harness these technologies effectively.

Investors should closely monitor how AI is reshaping traditional industries. For instance, the integration of AI in healthcare aims to revolutionize diagnostic and treatment methodologies, promising improved outcomes and reduced costs. Similarly, in finance, AI is being leveraged to enhance decision-making processes and fraud detection, providing robust growth opportunities.

In finance, the Top Cheap AI Stocks are being closely watched for their decision-making enhancements.

Companies focused on AI development are strategically investing in cutting-edge research, with a focus on creating scalable and adaptable AI solutions. It’s this commitment to innovation that sets the stage for future market dominance. By investing in AI stocks, traders can tap into these industry shifts, aligning their portfolios with the anticipated technological changes.

The potential for AI to disrupt and redefine industries can’t be underestimated. The stock market is increasingly valuing companies that are not just incorporating AI into their operations but are pioneering new applications. This growth potential is driving interest and investment, with many viewing 2026 as a pivotal year for AI advancements.

The growth potential of the Top Cheap AI Stocks cannot be overlooked.

Investors who understand these future trends can better position themselves to capitalize on the expected growth. By identifying companies that are leaders in AI technology, one can leverage advancements to secure significant returns. As AI continues to evolve, staying informed and strategically aligned with these trends will be crucial for anyone looking to make intelligent investment decisions in AI stocks. This foresight, combined with a keen understanding of AI’s transformative power, can lead to a successful investment strategy in the AI domain.

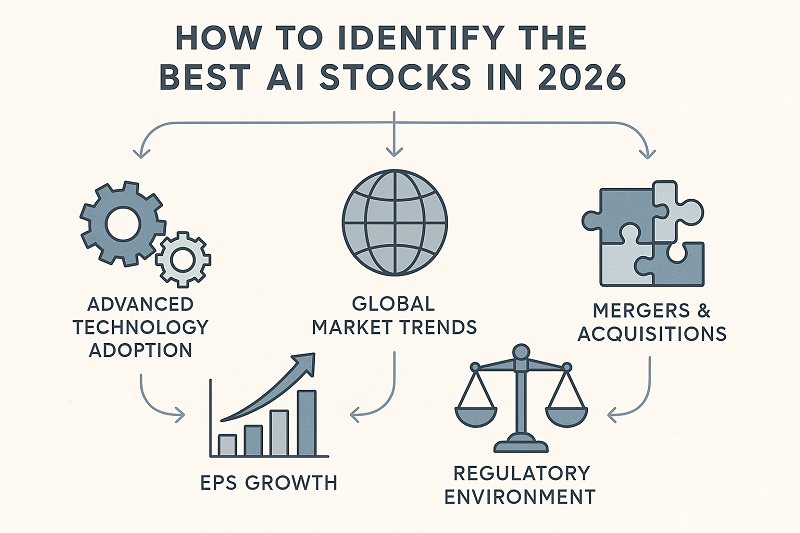

How to Identify the Best AI Stocks in 2026

As you navigate the landscape, consider how the Top Cheap AI Stocks align with your investment strategy.

As the AI landscape evolves, recognizing the best AI stocks in 2026 requires a strategic blend of analysis and foresight. Investors need to evaluate both qualitative and quantitative factors that impact a company’s potential for growth and profitability in the AI sector.

Key considerations include technological innovations, market positioning, and forward earnings estimates, which can help traders spot undervalued opportunities or emerging stars. Leveraging technical analysis, traders can refine their strategies and maximize returns. Ultimately, identifying the most promising AI stocks involves a comprehensive approach that combines market research, expert insights, and astute investment tactics.

The Top Cheap AI Stocks present unique opportunities for forward-thinking investors.

Key Factors to Consider in Stock Analysis

Investors should prioritize the Top Cheap AI Stocks that promise innovation and growth.

Analyzing AI stocks for investment in 2026 involves a broad spectrum of factors crucial for making informed decisions. First and foremost, understanding a company’s growth potential within the AI industry is paramount. A firm grasp of where it stands in technological innovation compared to its peers can indicate its market strength. Investors should focus on a company’s involvement in cutting-edge AI advancements such as natural language processing, autonomous vehicles, and AI-driven cybersecurity. These areas are not just roadmaps for innovation; they also indicate the company’s capacity to generate expansive revenue streams, making them attractive propositions in the stock market.

Earnings estimates and forward earnings potential also play critical roles in pinpointing the best AI stocks. Forward earnings are projections of a company’s profitability and a crucial indicator of future stock performance. By examining forward earnings and comparing them with industry benchmarks, investors can identify opportunities in undervalued stocks with growth potential. It’s important to consider the company’s revenue diversity in deploying AI. Companies that apply AI across various sectors such as healthcare, finance, and energy may possess broader revenue bases and more stability against market fluctuations.

Monitoring the Top Cheap AI Stocks reveals insights into future performance.

Another pivotal factor is a company’s investment in research and development (R&D). Companies that allocate significant resources towards R&D are often positioned at the forefront of technological progress, presenting promising prospects for growth. This proactive approach to developing scalable AI solutions aligns with future trends in AI technology, where innovation is synonymous with market leadership.

Investors should also assess a company’s competitive landscape. Understanding its position relative to competitors in terms of market cap and innovation capability can offer insights into its potential to lead the industry. Monitoring companies that frequently release updates or engage in high-profile collaborations can be indicative of strong market positioning. By actively analyzing these factors, traders can craft a strategy to discern the most promising AI stocks, harnessing the growth and technological advancements that the AI sector promises in 2026. Aligning investment choices with these elements could lead to a substantial upside as these AI companies mature.

Aligning investments with the Top Cheap AI Stocks could amplify returns.

Role of Technical Analysis in Selecting AI Stocks

Technical analysis plays a significant role in selecting AI stocks, offering a data-driven approach to understanding market trends and price movements. Unlike fundamental analysis, which focuses on a company’s intrinsic value, technical analysis examines past price data and trading volumes to forecast future price movements. It’s particularly beneficial for traders looking to capitalize on short- to medium-term opportunities in the stock market, especially in the volatile tech sector like AI.

Technical analysis of the Top Cheap AI Stocks can provide a deeper understanding of market trends.

Investors often employ technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands to identify potential buying or selling points. By observing these patterns, traders can make informed decisions based on market behaviour rather than solely relying on company performance metrics. For instance, moving averages help in identifying trend directions, while RSI indicates overbought or oversold conditions, providing cues on possible price reversals. Such insights are invaluable for pinpointing entry and exit points in AI stocks, ensuring optimal timing for trades.

The use of technical analysis allows investors to gauge market sentiment surrounding a particular AI stock, predicting shifts based on historical price movements. This is especially crucial for AI stocks, where market perceptions can change rapidly with technological breakthroughs or shifts in regulatory policies. By comprehensively analyzing these patterns, traders can align their strategies to exploit market inefficiencies effectively.

Investors should assess the movement of the Top Cheap AI Stocks to gauge market sentiment.

For those focused on long-term growth within AI investments, technical analysis can complement fundamental analysis, offering a holistic view of a company’s stock performance. By understanding both short-term market dynamics and longer-term growth prospects, investors can create well-rounded investment strategies that leverage the strengths of both approaches. As the AI sector evolves, blending technical indicators with fundamental insights equips traders with the tools necessary to navigate the complexities of the AI stock market successfully.

Moreover, integrating technical analysis with an awareness of current and future AI trends allows traders to anticipate market movements driven by innovation. By staying informed and leveraging the predictive power of technical analysis, investors can maximize their potential returns on AI stocks, aligning their portfolios with the latest advancements and market developments.

The evolution of the Top Cheap AI Stocks will significantly influence investment strategies.

Top AI Stocks to Watch in 2026

Investing in AI stocks in 2026 is something every astute investor should consider, especially as artificial intelligence continues to redefine technological landscapes. With companies like Microsoft leading the charge, the market is abuzz with cheap AI stocks poised for exponential growth. As emerging AI innovations unfold, these stocks offer a compelling opportunity backed by long-term growth potential. Recognizing the top AI stocks now could translate into significant returns as the market matures and companies further embed AI into their core operations.

In 2026, expect the Top Cheap AI Stocks to lead the charge in transformative technologies.

Spotlight on Emerging AI Innovations

The landscape of artificial intelligence is bustling with new developments that signal potential for both industry transformation and investment opportunities. Emerging AI innovations are capturing the attention of investors eager to get in on technologies predicted to revolutionize the market. In 2026, AI stocks are especially intriguing as they embody this wave of technological advancement.

The emergence of the Top Cheap AI Stocks signals a new wave of investment innovation.

Among the many companies blazing this trail is Microsoft, leveraging vast resources to expand its AI capabilities. The firm is not only leading in integrating AI across its products but also in setting a technological benchmark for others. Microsoft’s initiatives in AI have placed it at the forefront of innovations driving significant shifts in diverse sectors, from healthcare to autonomous vehicles. As AI technologies become more sophisticated, these sectors offer lucrative opportunities for investors eyeing AI stocks.

Investors should pay attention to how emerging AI innovations are influencing market dynamics. For instance, the evolution of natural language processing is reshaping how businesses interact with technology, offering seamless, intuitive user experiences. Companies that harness these advancements will likely experience a surge in market value and offer enticing investment opportunities. AI-driven cybersecurity solutions are another area with immense growth potential, as businesses continue to seek more robust security measures in an increasingly digital world.

Watch for the Top Cheap AI Stocks as they redefine industry standards.

Amidst this backdrop, cheap AI stocks stand out as fertile ground for investors who want to capitalise on the initial stages of technology adoption. With many companies investing heavily in research and development, the prospects for innovation and market leadership have never been brighter. By identifying and investing in companies that are leaders in these AI innovations, investors can tap into the expanding opportunities and ride the wave of technological growth into 2026.

Traders and investors should closely monitor how these advancements unfold. Those who do will be well positioned to seize opportunities as new technologies redefine traditional industries and alter the stock market landscape. A proactive approach, informed by market analysis and trend assessments, positions traders to benefit from AI’s transformative impact on the stock market and broader economy.

Staying informed about the Top Cheap AI Stocks is essential for successful investing.

Long-term Growth Potential of AI Stocks

Investing in the Top Cheap AI Stocks is an opportunity for long-term growth.

As 2026 approaches, the long-term growth potential of AI stocks remains a central talking point for many investors and traders. The continued advancements in artificial intelligence technology are paving the way for sustained stock market growth. Given the influx of investments into AI, its integration across multiple industries promises substantial returns for those who strategically invest in AI stocks.

With the likes of Microsoft leading this charge, established tech companies are significantly contributing to the AI market’s growth. Their consistent investments in AI R&D underscore the critical role they play in shaping future technological landscapes. By diversifying AI deployment across various sectors, these companies are not just enhancing their service portfolios but are also setting the stage for stable, long-term growth. This makes AI stocks particularly attractive as they offer growth potential that aligns with broader market trends.

With a focus on the Top Cheap AI Stocks, investors can shape their financial futures.

Investors aiming to benefit from AI stocks should consider the role of diversification in their investment strategies. By selecting a mix of companies across different sectors that are integrating AI, investors can cushion against market fluctuations and enjoy proportionate growth driven by technological advancements. This approach allows them to accommodate any shifts in market dynamics while capitalizing on the growth of AI technologies in healthcare, finance, and more.

Moreover, the potential for future technological breakthroughs further enriches the growth narrative for AI stocks. As AI continues to develop, technologies such as machine learning offer tremendous potential for creating innovative products and services, driving market demand and, consequently, stock value. This fosters a conducive environment for long-term investment, with AI stocks offering a robust outlook in terms of profitability and market relevance.

Exploring the Top Cheap AI Stocks can unveil new avenues for innovation.

Positioning one’s portfolio to include AI stocks is a strategic move toward securing future returns as the market for AI technologies expands. The growth trajectory observed in the AI sector heralds robust opportunities for those prepared to align their investments with this technological wave. Traders focused on sustainable, long-term growth would do well to consider AI stocks, which promise to redefine industries with cutting-edge developments and a strategic vision toward the future.

The conversation around AI stocks is set to intensify as we move further into 2026, with opportunities becoming more pronounced. Active engagement with the latest market trends and understanding of emerging technologies will enable traders to make informed decisions. By maintaining a focus on long-term growth, investors can navigate the intricate landscape of AI stocks and secure a pivotal role in the future of technology-driven markets.

Understanding the Top Cheap AI Stocks can amplify your investment strategy.

Investment Strategies for AI Stocks

Navigating AI stocks in 2026 demands adept investment strategies to harness the technological tide. Investors, from those eyeing short-term gains to long-term growth seekers, need to balance the scales of risk and reward. Understanding market trends, potential revenue streams from innovations in AI, and the competitive landscape paves the way for strategic investments. As AI giants like Microsoft lead the charge, the focus shifts on companies with robust growth and technological potential. Explore the nuances of balancing risk and reward in AI investments to make the most of this evolving domain.

The right strategies with the Top Cheap AI Stocks can lead to substantial returns.

Balancing Risk and Reward in AI Investments

As traders and investors delve into AI investments, striking the perfect balance between risk and reward becomes paramount. The AI stocks market, especially as we approach 2026, is characterized by its vibrant dynamics, largely driven by groundbreaking technological innovations. To succeed in this landscape, a solid grasp of the risk-reward equation is essential. Investors need to recognize that while the allure of high returns is strong, potential risks are inherent, primarily due to the market’s rapidly evolving nature and inherent volatility.

Investing in the Top Cheap AI Stocks requires balancing risks for rewarding outcomes.

Focusing on viable investment strategies can help tip this balance. Start by identifying AI companies with a proven track record of revenue growth and sustained product innovation. Look for businesses that exhibit not just significant technological prowess but also sound financial health and management expertise. Microsoft, for instance, is a prominent player that has consistently demonstrated both leadership and innovation in the AI sector. Their investments in diverse applications of AI, from data analytics to cloud computing, provide traders with a glimpse into an area of future potential and current stability.

When diving into AI stocks, diversification is another key component in managing risk. Spreading investments across multiple AI sectors, such as healthcare, finance, and autonomous technologies, helps mitigate risk exposure. This strategy allows traders to capitalize on growth across various market segments, ensconcing investments through fluctuations in a single niche or industry. Diversification ensures that one’s portfolio can weather market volatility by relying on gains in multiple avenues rather than a singular focus.

Diversifying investments in the Top Cheap AI Stocks can mitigate risks effectively.

Moreover, keep an eye on the competitive landscape involving emerging AI technologies expected to create new market arenas. Companies focusing on cutting-edge developments like AI-driven cybersecurity measures, improved natural language processing capabilities, and next-generation autonomous vehicle technologies are on many traders’ watchlists. These innovations not only promise potential for market expansion but also suggest increased revenue streams for forward-thinking companies.

Understanding market dynamics also includes assessing a company’s potential to scale these innovations and address real-world challenges efficiently. This scalability can often be a determinant of a company’s future growth trajectory and thus its stock valuation. Traders should remain agile, adapting their strategies as new AI trends emerge and as the broader market reacts to economic changes or technological breakthroughs.

Risk management shouldn’t overshadow the potential for reward. The AI stock market is rich with opportunities for high returns, especially given the continuous influx of investment and development in AI technologies. For proactive traders, who keep abreast of technological evolution and market signals, the rewards can outpace risks. An informed investment approach in AI stocks will likely yield substantial returns by 2026, capitalizing on both the inherent market potential and the disruptive power of AI advancements.

Understanding the potential of the Top Cheap AI Stocks can enhance investor confidence.

Ultimately, the journey of balancing risk and reward in AI investments is about making insightful decisions informed by comprehensive research and strategic foresight. By aligning with the pulse of AI trends and maintaining a diversified, well-researched portfolio, investors can navigate the complexities of the AI stock market while maximizing both profit potential and investment security.

In the dynamic world of AI, investing in affordable AI stocks offers a unique opportunity to engage with a high-growth industry. With innovation driving advancements and increasing demand for AI solutions, these stocks could be pivotal in shaping a prosperous portfolio. As you consider these affordable options, always assess your financial goals and risk tolerance. Stay informed, remain proactive, and make well-researched decisions to stay ahead in the AI investment frontier. Download our latest guide for more insights into capitalizing on AI trends effectively.

As you consider your options, reflect on the benefits of the Top Cheap AI Stocks.

FAQs: Top Cheap AI Stocks 2026 – Best AI Stocks to Buy Now

What are the key AI stock trends to watch in 2026?

Key trends include advancements in natural language processing, AI-driven cybersecurity, and the integration of AI in sectors like healthcare and finance. These trends present promising opportunities for growth in the AI stock market.

How can investors identify promising AI stocks in 2026?

Investors should evaluate technological innovations, market positioning, forward earnings estimates, and the company’s ability to monetize AI technologies across different sectors.

Key factors:

1. Technological innovations

2. Market positioning

3. Forward earnings estimates

4. Revenue potential from AI deployment

Why is diversification important in AI stock investments?

Diversification across various sectors, such as healthcare and finance, helps balance risk and maximize growth. It cushions the portfolio against market fluctuations, ensuring stability and broader revenue streams.

What role does technical analysis play in AI stock investment strategies?

Technical analysis helps traders predict AI stock market trends by examining past price data and trading volumes, complementing fundamental analysis for a well-rounded investment strategy.

Common techniques:

1. Moving averages

2. Relative strength index (RSI)

3. Bollinger Bands

How can investors balance risk and reward in AI stock investments?

Investors should focus on companies with strong revenue growth, a solid track record of innovation, and robust financial health. Diversifying investments across multiple AI sectors can also help manage risk while capitalizing on growth potential.