Brett Eversole’s True Wealth has become one of the most talked-about investment research services on the market—and for good reason. As the financial world buzzes about the possibility of a record-breaking “Melt Up Tsunami,” with more than $7.4 trillion in cash poised to flood into stocks and alternative assets, Brett Eversole’s True Wealth stands at the forefront, providing investors with clear, actionable research that may define the next decade of wealth creation.

At this pivotal moment, when economic uncertainty and opportunity exist side by side, Eversole’s guidance offers clarity and strategy for anyone eager to capitalize on transformative market trends.

His track record, combining rigorous data analysis with market-tested intuition, has helped thousands of readers navigate cycles of euphoria and panic. Now, as we approach what he calls the “most powerful melt up in market history,” Brett Eversole’s True Wealth is uniquely positioned to help both new and experienced investors make the most of every dollar they have at work.

Below, we’ll explore the full scope of Brett Eversole’s Melt Up thesis, why so much “dry powder” on the sidelines could ignite a once-in-a-generation rally, and how the research, alerts, and special reports inside True Wealth can help you seize this fleeting opportunity—before the rest of the world catches on.

Brett Eversole’s True Wealth: Why Investors Are Watching This Melt Up

If you look at market cycles, they tell a powerful story. Periods of risk aversion result in massive cash buildups, like the kind we see now after years of pandemic uncertainty, volatile policy shifts at the Federal Reserve, and cyclical booms that have left many wary of “buying in high.” Yet, market history teaches us that the end of a bull market is rarely orderly or slow. More often, an explosive surge—commonly called a melt up—creates breathtaking new highs as hesitant investors finally pour in, afraid to miss out on the final act.

Eversole’s research pinpoints $7.4 trillion as the “dry powder” currently sitting on the sidelines, awaiting a signal to move. This is not theoretical capital; it’s real money in money markets, savings accounts, and low-yield vehicles.

When this cash begins to chase performance and excitement, it can fuel a feedback loop where rising prices breed more buying, creating self-fulfilling momentum. The “mother of all melt-ups” isn’t wishful thinking: it’s the logical outcome of pent-up demand, policy stances, and crowd psychology colliding.

Eversole isn’t just throwing darts; he’s constructed a model portfolio with 264 winning investments, covering times of abundance and crisis. Readers frequently praise his “level-headed” approach, prioritizing actionable, data-driven insights over market gimmicks or hype.

With True Wealth, Eversole’s philosophy is clear: seek out what is safe and cheap but poised for a surge as market sentiment flips. His universe includes everything from breakthrough growth stocks and gold plays to high-yield dividend stalwarts and even unique “secret currency” strategies most mainstream analysts miss.

The Inner Workings of True Wealth

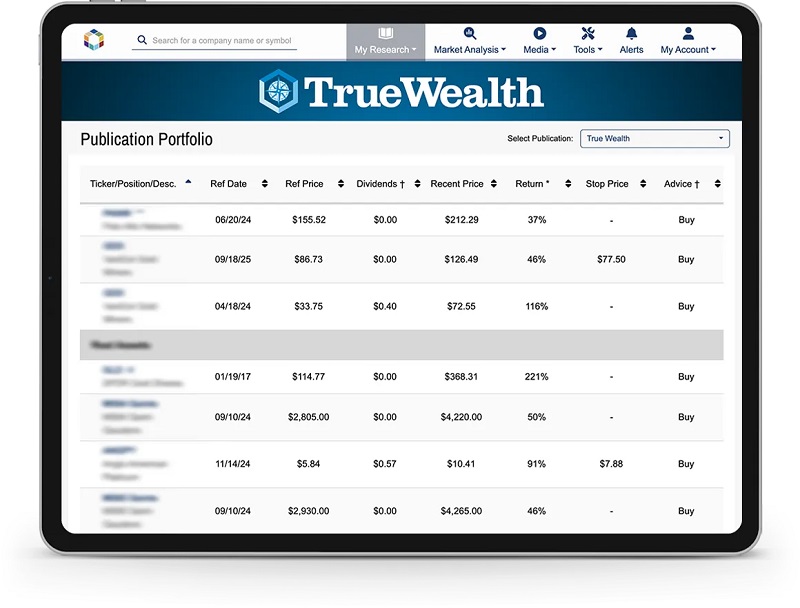

A subscription to Brett Eversole’s True Wealth offers immediate, full access to Brett’s model portfolio—meticulously updated and spanning dozens of sectors and ideas. Each investment recommendation is carefully vetted by Brett and his research team, reflecting both macro trends and company-specific catalysts.

Alongside this portfolio, members receive new monthly issues with deep-dive analyses, continually refreshed buy lists, and real-time market alerts. These updates are not just surface-level: every thesis is fleshed out with supporting data, charting market dynamics, examining catalysts, and providing clear instructions on when to enter or exit trades.

Subscribers find that one of True Wealth’s core strengths is its transparency. Readers are never left to guess when to act. If a market event warrants selling a position or seizing a new opportunity, Brett sends explicit, timely alerts—sometimes before the headlines break. This approach empowers independent investors, providing a sense of control regardless of market volatility.

Inside Brett Eversole’s True Wealth: Portfolio Access, Research, and Special Reports

Each year, members receive more than just regular recommendations. Included in the latest package are several special research reports, each reflecting a new facet of the Melt Up thesis.

The highly anticipated “Never Bet Against America” report explores five companies with the potential to multiply five-fold or more during the imminent market melt up. Instead of recycling overhyped tech giants, Brett identifies hidden gems just beginning to catch institutional and retail attention. These stocks, while “cheap” by many measures, share the characteristic of being on the verge of major capital inflows as broader market sentiment becomes feverish.

Another invaluable resource is “$8,000 Gold and Beyond,” in which Brett argues that the conventional wisdom on gold is deeply flawed. Drawing on monetary policy trends, Bretton Woods history, and present-day demand surges, he contends that gold is nowhere near a peak—and that the surge in liquidity can double or even triple the price from here. Importantly, he provides actionable ways for average investors to gain exposure—often with one-click ETFS or innovative gold proxies that eliminate the need for physical bullion.

For those craving more diversity, the “Unexpected Profits” briefing unveils income and growth opportunities in utterly forgotten corners of the market. Eversole’s research spots trends before they hit the mainstream press, offering readers first crack at segments poised for capital rotation.

Lastly, “A Secret Currency That Could Pay You 500%” introduces a time-tested asset class—little understood by most U.S. investors but beloved by the world’s most sophisticated family offices and institutions. This “secret currency” stands to benefit as new liquidity finds its way into less crowded, high-upside alternatives.

What Makes This Melt Up Different?

At the heart of Eversole’s thesis is the conviction that this cash-driven surge will be uniquely powerful. The size of the cash pile is historic, and U.S. markets have never seen so much liquidity parked in short-term vehicles, waiting for a catalyst.

As policy pivots occur—whether it’s an easing of interest rates, new fiscal measures, or simply a wave of positive earnings surprises—this capital can “flip” overnight. What follows could be one of the fastest, most volatile but also lucrative bull market climaxes on record.

Eversole anticipates not just gains in mega-cap tech but also a broadening melt up into precious metals, income stocks, and overlooked sectors. This is where True Wealth’s research shines: it tracks where the flows are starting to rotate, positioning readers in front of those flows, rather than chasing after them after the rally is obvious.

No market opportunity comes without risks, and Eversole does not shy away from hard truths.

The melt up phase is often fast and furious—returns can be remarkable for those who move early but punishing for the latecomer who buys at irrational peaks. Timing and discipline are vital. The research, therefore, pairs every buy suggestion with clear exit strategies and risk controls, ensuring readers are not blindsided when the music stops.

The True Wealth philosophy admits that not every pick will be a winner, but the system is designed so that double- and triple-digit gains dramatically outweigh occasional setbacks. By diversifying across asset types and being ruthless in taking gains, Eversole seeks to ensure that readers enjoy the bulk of the Melt Up’s bounty—without getting swept up in the fallout.

Real-World Results and Reader Experiences

It’s not just theory. Eversole’s True Wealth has earned the trust of more than just “bull market” investors.

Letters from subscribers report not only significant gains on highlighted stocks, gold plays, and overlooked market niches, but also confidence during drawdowns.

What separates the experience are the frequent, detailed updates—even during times of volatility—helping readers stick to their plan, avoid emotional mistakes, and seize re-entry points when others panic.

How to Get Started with Brett Eversole’s True Wealth

Enrolling in True Wealth is straightforward. After joining at the current steeply discounted rate, members obtain instant, password-protected access to the full model portfolio, recent and archived issues, and the latest bonus reports. Importantly, the 30-day, risk-free guarantee removes any barrier to trial—if the results don’t meet expectations, a full refund is a simple request away, and all delivered materials remain yours.

As part of membership, subscribers also receive Stansberry Digest and DailyWealth, two briefings that connect them to a network of veteran analysts and real-time market narrative. This ongoing education ensures that readers don’t just passively follow picks but learn the logic behind trends, cycles, and asset allocation shifts.

Who Gets the Most From Brett Eversole’s True Wealth?

True Wealth is not for high-frequency traders chasing every tick, nor is it a “black box” algorithm. Its strength lies in empowering self-directed investors who want actionable research, historical context, and ongoing support.

Whether you’re rolling over a 401(k), managing taxable investments, or just starting with modest savings, the service is designed for all levels—providing both step-by-step instructions for beginners and deep dives for advanced readers.

The Unrivaled Value of the Current Offer

Right now, Brett Eversole’s Melt Up thesis is matched by one of True Wealth’s best offers ever: 84% off the standard price, with all the rich benefits of the standard service, plus hundreds of dollars in new research and actionable intelligence. It’s a reflection of Eversole’s and Stansberry’s intent to broaden access, ensuring as many people as possible can prepare for what might be the last major market melt up for years to come.

As U.S. markets stand on the precipice of unprecedented liquidity and historic opportunity, Brett Eversole’s True Wealth offers not a promise, but a plan.

Subscribers will be equipped to avoid the pitfalls of FOMO, protect against the inevitable reversal, and capture maximum upside as the market surges. The coming Melt Up is not a matter of “if,” but “when”—and thanks to True Wealth, you can stand ready with research, strategy, and community by your side.

Frequently Asked Questions

What is the “Melt Up Tsunami” Brett Eversole describes?

It’s the surge in market prices triggered by a sudden rush of sidelined cash—$7.4 trillion by some estimates—moving rapidly into stocks, gold , and alternative assets as the investment climate shifts from fear to optimism. Eversole believes this could be the most powerful such event in decades.

Do I need to be an advanced investor to follow True Wealth?

Not at all. The service is built for all experience levels, with plain-English explanations and guidance on every trade or alert.

What’s the best way to use the research and alerts?

The key is to act promptly, diversify appropriately, and stick to the plan. Eversole’s approach includes initial entry points, follow-up buys, and clear sell guidance.

Are the gains guaranteed?

As with all market investments, there’s no guarantee—but the historical record of 264 wins, real-time alerts, and broad diversification put the odds in your favor.

How do I start my risk-free trial and what do I receive?

Sign up through the official invitation, and you’ll get complete access to the member site, research, archives, all bonus reports, and your 30-day, money-back guarantee.