Diving into the world of artificial intelligence stocks doesn’t have to be expensive. If you’re seeking affordable entry points into the AI sector, look no further. Our curated list of best AI stocks under $10 offers incredible opportunities without breaking the bank. Designed for investors eager to capitalize on the burgeoning tech landscape, these stocks present potential growth fueled by innovation and demand. Whether you’re a seasoned trader or a curious beginner, our guide equips you with insights to make informed decisions. Start your investment journey in AI today and explore these budget-friendly, promising stock picks. Investing in the best AI stocks under $10 is a savvy choice for those looking to maximize growth.

Key Highlights

Explore the best AI stocks under $10 to seize promising opportunities in the tech market.

- AI stocks under $10 offer substantial growth potential and affordable entry for investors in the burgeoning tech landscape.

- Analyzing market trends and historical performance is crucial for maximizing returns in budget-friendly AI stock investments.

- Investors should consider both emerging computing penny stocks and high-value AI stocks for diversified income growth.

- Market cap insights are essential when evaluating AI stocks’ risk and reward, impacting investment strategy and potential stability.

- Utilizing comprehensive tools and resources empowers investors to navigate the AI stock market and identify lucrative opportunities.

Understanding the Appeal of Best AI Stocks Under $10

Understanding the best AI stocks under $10 can help investors make wise financial decisions.

Diving into the world of best AI stocks under $10 reveals a treasure trove of exciting opportunities and potential rewards. As technology continues to advance, investing in artificial intelligence stocks becomes increasingly appealing for traders and investors alike.

With the best AI stocks under $10, you can diversify your portfolio while capitalizing on the AI revolution.

These stocks offer unique growth potential combined with low entry costs, making them an attractive choice for those with a keen eye on emerging trends. By identifying the right stock picks, you can leverage the earnings growth of rapidly evolving technology companies. Let’s explore these AI stocks and decode the market trends that could influence their future performance.

Investing in the best AI stocks under $10 allows investors to participate in transformative technology.

Why AI Stocks Offer Unique Investment Opportunities

Our selection of the best AI stocks under $10 highlights companies poised for rapid growth.

AI stocks under $10 offer a unique entry point for traders and investors looking for promising technology company investments with manageable risks. The allure of investing in artificial intelligence stocks lies in their significant growth potential and the innovation-driven segments they span. What makes these penny stocks stand out is not just their affordability but their potential to become tomorrow’s tech giants. Investors focusing on AI stocks recognize the transformative nature of technology, from machine learning algorithms to natural language processing, all of which are paving the path for substantial earnings growth.

Choosing the best AI stocks under $10 can yield significant returns for astute investors.

For a trader or investor on the lookout for the next big stock pick, AI stocks under $10 represent the potential for high returns without requiring a large initial investment. By understanding the nuances of AI, one can grasp the future market trends that these companies may influence. The sector’s dynamic nature makes it ripe for those willing to explore the depths of investment research, staying abreast of developments and adapting strategies accordingly.

Investors should keep an eye on the best AI stocks under $10 for potential market-changing innovations.

Investing in AI stocks isn’t just about capitalizing on growth but also about supporting innovations that could redefine industries. The technology behind these stocks often drives improvements in efficiency, decision-making, and even sustainability, offering not only financial returns but also the satisfaction of contributing to tech that makes a difference. Analyzing company performance and market trends, investors can pinpoint opportunities that align with their financial goals. As technology continues its rapid advancement, aligning your trading strategies with the pulse of the industry could lead to discovering some truly rewarding stocks.

Investing in the best AI stocks under $10 not only offers financial gains but also supports technological advancements.

Examining the key benefits of investing in AI stocks under $10:

The best AI stocks under $10 provide an excellent opportunity for new investors.

- Increase in industry-wide technological innovations:

- Investing in AI stocks can lead to advancements and breakthroughs in technology, which can result in improved products and services across various sectors.

- Support for innovation in AI contributes to the evolution of technologies that solve complex problems and improve efficiency and productivity.

- Access to diverse technology sector growth:

- Investors can diversify their portfolios by including a range of AI-driven companies with varied applications, from healthcare to autonomous vehicles.

- Diversification can help mitigate risk by spreading investments across different areas of the technology sector.

- Opportunity for significant financial returns with low initial investment:

- AI stocks under $10 provide a low entry point for investors, allowing them to participate in the potential growth of the AI sector without a substantial financial commitment.

- There is potential for high returns if these companies achieve significant breakthroughs or partnerships.

- Early entry into potentially transformative companies:

-

- Investors have the chance to support and benefit from companies that may become leaders in AI technology as they develop and grow.

Consider the best AI stocks under $10 to diversify your investment strategy.

- Investing early in emerging AI companies can lead to substantial gains if the company experiences rapid growth or success.

-

- Exposure to developments in AI and machine learning:

-

- Investing in AI provides investors with insight into cutting-edge technologies and how they are being applied across various industries.

Focusing on the best AI stocks under $10 can enhance your portfolio’s performance.

- Understanding these developments can help investors make informed decisions about other potential investments.

-

- Contribution to advancements in sustainability through tech:

- AI technology has the potential to drive sustainable practices by optimizing resources and reducing waste in various industries.

- Investors can contribute to and benefit from innovations that focus on environmental sustainability and social responsibility.

- Potential influence on future market trends:

-

- AI is positioned to significantly influence future market trends, and investing in this sector allows investors to be part of its impact on the global economy.

Investors are increasingly turning to the best AI stocks under $10 as a strategy for growth.

- Being involved in shaping market trends can provide long-term strategic advantages and returns.

-

These points underscore the compelling aspects of investing in AI, shaping informed decisions for prospective investors.

The best AI stocks under $10 are essential for building a balanced investment portfolio.

Analyzing Market Trends for Budget-Friendly AI Stocks

Market trends play a pivotal role in shaping the potential of AI stocks under $10, and understanding these trends can significantly benefit investors and traders looking to make informed decisions. Historical performance, sector growth, and economic indicators all provide valuable insights into the future trajectory of these penny stocks. Investors aiming to strike a balance between risk and reward should focus on the emerging patterns within the AI landscape.

Understanding market trends related to the best AI stocks under $10 is key for success.

One key trend is the increasing adoption of artificial intelligence across various industries. From healthcare to finance, AI’s integration is transforming business operations, thereby boosting the prospects of related technology companies. As these companies gain traction, their stock values are positioned to reflect that growth potential. Investors can conduct detailed investment research to identify which stocks might benefit most from these industry shifts.

Another crucial aspect is the international expansion of AI technologies. As global markets become interconnected, there’s an increasing demand for AI solutions, driven by their capability to optimize processes and provide competitive advantages. Traders interested in maximizing their earnings growth should watch for companies with robust international strategies; those able to capture market share abroad can offer substantial returns.

Market trends also indicate a growing focus on sustainable investing, where environmental, social, and governance (ESG) criteria become integral to investment decisions. AI stocks that prioritize sustainable innovation may attract more investors looking for ethical and profitable company investments. By analyzing these trends and following the performance patterns of AI stocks, investors can identify the ones that not only fit their budget but also align with broader market movements, ensuring a well-rounded and informed investment strategy.

Top AI Penny Stocks to Watch

Identifying the best AI stocks under $10 can yield significant investment returns.

AI penny stocks represent an exciting frontier for investors and traders eager to explore the burgeoning world of low-cost technology investments. These stocks provide an entry point into the rapidly advancing sphere of artificial intelligence, offering potential high returns with minimal initial outlay.

As the AI sector expands, discovering the top penny stocks can lead to significant opportunities. In this realm, computing penny stocks stand out for their innovation and capacity to drive future tech advancements. Let’s delve into key factors and explore the potential these stocks hold for savvy traders and investors alike, seeking strategic growth and diversification.

Investors should look for the best AI stocks under $10 to maximize their portfolio’s potential.

Exploring the Potential of Computing Penny Stocks

Computing penny stocks are often the best AI stocks under $10 to consider for futuristic growth.

Computing penny stocks are among the hidden gems in the investment landscape, especially for those intrigued by the future of artificial intelligence. These stocks reside at the intersection of technology and AI growth, offering investors unique opportunities to participate in fundamental innovations shaping tomorrow’s digital world. What’s intriguing about computing penny stocks is their capacity to revolutionize various sectors through emerging technologies. With a strategic focus on advancements such as edge computing, machine learning, and quantum computing, these companies often drive significant improvements in efficiency and productivity.

For a trader or investor eyeing the next wave of tech breakthroughs, computing penny stocks offer a compelling proposition. These stocks often involve companies that are not yet leaders in their field but have the potential to disrupt industries with cutting-edge solutions. As AI continues to infiltrate every aspect of business and daily life, integrated solutions from these smaller tech players could position them as key enablers of digital transformation. This anticipated growth encourages investors to look beyond present performance, focusing instead on the potential that these tech innovations hold.

Additionally, computing penny stocks can provide diversification in an investment portfolio, allowing investors to hedge against more volatile sectors while capitalizing on technological advancements. However, the challenge lies in identifying the right stocks with genuine growth potential. This requires thorough investment research and an understanding of industry trends and tech developments. Investors who successfully navigate this space can discover stocks with substantial upside potential, increasing their chances of earning rewarding returns from strategic investments. As these companies evolve, monitoring their trajectory can offer insights into future industry leaders and potentially drive significant portfolio appreciation.

Engaging in computing penny stocks requires diligence and a forward-thinking mindset. As an investor, it’s vital to remain vigilant about technological advancements and market conditions influencing AI’s trajectory. The possibility of unveiling a stock pick with exponential growth underscores the essence of staying informed and agile. For those willing to delve deeper into the specifics of AI trends and computing advancements, these stocks offer not just a financial promise but a chance to be part of the AI evolution at a foundational level, potentially setting the stage for long-term investment success.

Key Factors to Evaluate Before Investing in AI Penny Stocks

Investing in the best AI stocks under $10 requires understanding key evaluation factors.

Investing in AI penny stocks is an exciting venture, but it’s essential to approach it with a clear strategy and an understanding of the key factors that drive these investments. Investors should first consider the underlying technology and innovation driving the stock. With AI being such a diverse field, identifying companies that are at the forefront of technological advancements can lead to promising returns. It’s crucial to evaluate whether a stock’s technological potential aligns with market demands and trends.

One important aspect to consider is the company’s growth potential. Does the company have a robust pipeline of projects or innovations that could drive future success? Examining the management team and their strategic vision can provide insights into the company’s ability to execute its growth plans and adapt to industry changes. Stability in leadership often translates to stability in executing business strategies, which is essential for any company aiming to capture market share in the competitive AI landscape.

Financial health is another crucial factor. For penny stocks, liquidity and cash flow are typically tighter, making financial health a particularly significant indicator of a company’s ability to withstand market fluctuations. Investors should dive into the financials, scrutinizing revenue trends, earnings growth, and debt levels, while keeping an eye on burn rates in relation to market developments and revenue streams.

Evaluating financial health is crucial when considering the best AI stocks under $10.

Moreover, the regulatory environment surrounding AI technologies can significantly impact investment viability. As regulations become more stringent amidst growing concerns over privacy and data security, companies that proactively address these topics may have better market positioning. Understanding the regulatory landscape and a stock’s adaptability to compliance issues enhances investment strategies, possibly leading to long-term sustainability.

Finally, conducting comprehensive investment research is paramount. Staying informed about industry news, technological advancements, and competitor performance can all influence stock decisions. Engaging with tools and resources dedicated to AI investments helps investors stay ahead of trends. Careful analysis and a strategic approach enable investors to make informed decisions, balancing risk and opportunity, and possibly identifying stocks under $10 that offer high returns aligned with AI’s impressive growth potential. Keeping an eye on these factors aids in making smarter, more informed investment choices, ultimately driving financial success and fulfilling investment goals in the dynamic AI sector.

High-Value Artificial Intelligence Stocks for Savvy Investors

Investors should explore high-value options among the best AI stocks under $10.

Diving deep into artificial intelligence stocks offers investors a treasure trove of opportunities. With technology steering new advancements, intelligence stocks with growth potential become a hot topic for savvy traders. Whether it’s exploring stocks with solid market cap or spotting emerging companies, investors committed to AI’s transformative impact are in for a rewarding pursuit. It’s crucial for traders to pinpoint stock picks that resonate with future tech evolutions to ensure stellar investment performance. Let’s delve into how to identify AI stocks promising robust returns and appreciate the significance of market capitalization in stock evaluations.

How to Identify Intelligence Stocks with Growth Potential

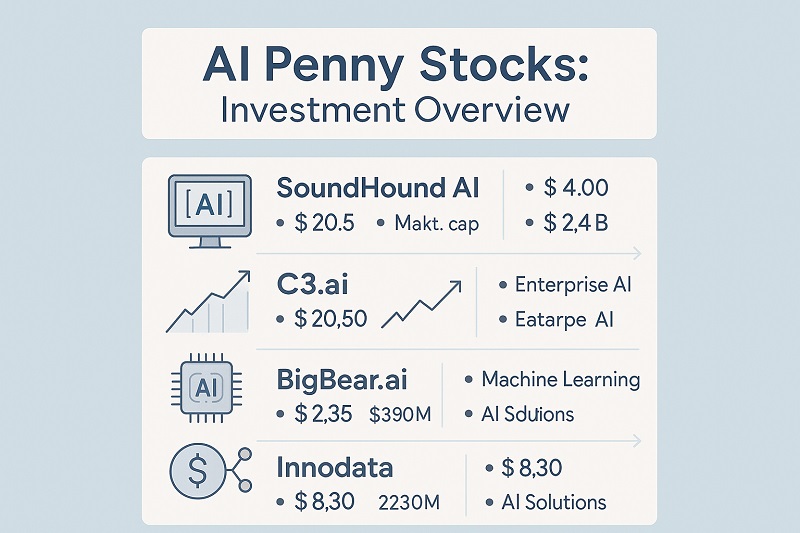

Discovering intelligence stocks with growth potential is more art than science, owing to the dynamic nature of the AI industry. A trader or investor must first dissect the operational landscape, focusing on companies with promising technologies that address pressing needs. When identifying stock picks under $10, it’s wise to scrutinize the company’s product pipeline and technological innovations. AI traders should consider Bigbear ai and its strategic approach to AI-driven solutions, which could signal success through high market demand.

Investing in the best AI stocks under $10 can lead to transformative opportunities in tech.

A company’s adaptability to changing market trends and its ability to innovate within its space can vastly influence its growth trajectory. For instance, Nokia NOK has repurposed its strategies to focus primarily on AI enhancements in telecommunications, making it a viable consideration for savvy investors tracking technological advancements. These adaptations are crucial, as they often drive a stock’s future performance and earnings growth. Traders should not overlook the value in a company constantly investing in research and development, as this can be a beacon of future market influence.

Investors should leverage a multi-faceted investment strategy including both qualitative and quantitative analysis. From evaluating revenue streams to inspecting the caliber of the leadership team, these factors collectively help define a stock’s growth potential. Moreover, the integration of AI solutions into broader industry sectors can enhance the performance of intelligence stocks. Companies functioning at this intersection often experience amplified prospects, especially in sectors like healthcare and finance where AI is proving indispensable.

Peer analysis also plays a significant role. By comparing the financial health and growth metrics to industry benchmarks, traders can pinpoint discrepancies or opportunities that others may have missed. This analysis can uncover undervalued stocks or those ripe for significant growth. Additionally, the ever-increasing global appetite for AI solutions means that companies with clear international strategies often stand a higher chance of capturing a share of untapped markets. As AI becomes integral to such varied fields, smart investors will tune into these trends, identifying intelligence stocks with substantial growth potential early on.

Understanding Market Cap in AI Stock Evaluation

Understanding market cap is essential to evaluating the best AI stocks under $10.

Market capitalization, or market cap, is a foundational measure of a company’s value and a critical element in evaluating AI stocks, especially those under $10. It plays a determining role when traders assess the robustness and viability of their stock picks. Generally, market cap offers insights into a company’s size, market position, and potential growth trajectory. It often aligns with how the market values AI’s transformative influence in specific sectors, making it vital for smart investment strategies.

Smaller market cap stocks might provide outsized growth opportunities compared to more established, larger cap companies due to their agility in the market. These companies can quickly adapt to technological shifts and react to new consumer demands, positioning themselves as attractive investment opportunities. However, their size might also entail higher volatility and risk, which savvy investors need to weigh carefully. Understanding the nuanced impact of market cap on stock performance helps traders make informed decisions.

Analyzing company-specific market cap trends is essential. Companies like Bigbear ai with a relatively smaller market cap could present stellar growth if they capitalize on their AI innovations astutely, breaching new markets or gaining industry traction. On the other hand, firms with larger caps like Nokia NOK can provide a steadier investment avenue through established AI portfolios and vast market networks. This dual effect makes balancing risk and opportunity pivotal as investors navigate their AI stock investments.

Furthermore, a company’s market cap is often reflective of its competitive standing and financial recessive capabilities. It can provide a buffer in turbulent markets, hinting at the firm’s ability to withstand economic shifts and sustain technological investments. Incorporating this metric into your evaluation framework assists in balancing immediate earnings potential against long-term sustainable growth. Astute traders focus on how market cap transitions reflect a company’s response to technological progressions and competitive forces within the AI field.

Investors can find promising opportunities in the best AI stocks under $10 through market cap analysis.

The appeal of investing in intelligence stocks with a promising market cap rests in recognizing the hidden potential these companies may harbor. While these investments carry inherent risks, they also offer the promise of significant returns under informed and strategic evaluation. Engaging in thorough research to understand how market cap factors into broader market trends provides a steadfast foundation for building a diversified AI stock portfolio. To trade effectively in this sector, investors need to not only monitor current market caps but also anticipate shifts in market expectations, staying a step ahead as AI continues to shape industry paradigms.

Building upon the previously mentioned fundamentals of AI stock investments, evaluating market cap emerges as a crucial component in strategic decision-making for investors. Here are some key approaches to consider:

Strategies for evaluating the best AI stocks under $10 are crucial for investment success.

-

- Compare Market Cap with Industry Peers: Analyze how a company’s market cap ranks relative to its competitors in the AI sector to assess its market positioning and growth potential.

- Examine Revenue Growth Trends: Investigate the relationship between market cap and revenue growth to determine if a company’s valuation aligns with its financial performance and future prospects.

Use trends in the best AI stocks under $10 to inform your investment decisions.

- Consider Market Cap in Valuation Metrics: Utilize market cap in conjunction with valuation ratios like P/E or P/S to get a comprehensive view of a company’s worth and investment potential.

- Assess the Impact of Market Cap on Liquidity: Larger market cap often means more liquidity, affecting how easily investors can buy or sell their shares without impacting the price.

- Evaluate Market Cap in Context of Innovation: Consider the company’s market cap in relation to its investment in research and development, signaling its potential to lead future AI breakthroughs.

Together, these approaches provide a framework that investors can use to gain insights into the dynamics of market cap within the AI stock landscape, helping them make informed investment choices.

Investors must remain aware of key indicators when investing in the best AI stocks under $10.

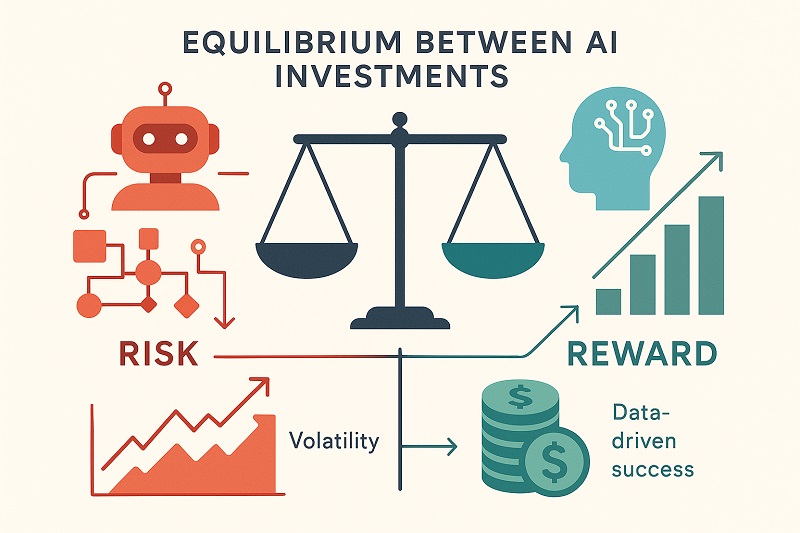

Risks and Rewards of Investing in AI Stocks

Balancing risk and rewards in the best AI stocks under $10 is crucial for long-term success.

Investing in AI stocks offers a unique combination of potential rewards and inherent risks. With the AI industry evolving rapidly, these stocks present exciting opportunities for growth, attracting investors eager to capitalize on innovation. However, the volatility associated with technological advancements does necessitate a strong understanding of the market’s nuances.

As traders and investors, it’s crucial to weigh the risks and rewards carefully. Our exploration will delve into strategies for balancing risk and reward in AI investments and how to minimize potential pitfalls, ensuring a comprehensive approach to investing in this dynamic sector.

Balancing Risk and Reward in AI Investments

Investing wisely in the best AI stocks under $10 can provide a high reward for managed risk.

Navigating the realm of AI investments requires a keen understanding of both the potential rewards and inherent risks. As with any growth-oriented asset, AI stocks offer the allure of substantial earnings growth, driven by the sector’s technological advancements and market demand. Investors keen on these stocks are drawn by the promise of breakthrough innovations, whether it’s in machine learning, natural language processing, or data analytics, which all hold the power to transform industries. These technologies influence not only company performance but also their stock value, offering a compelling case for investment.

However, the path to realizing these gains is laden with risk. The rapid pace of technological change means companies must continually adapt, requiring significant research and development investment. For an investor, the key is to balance these potential rewards against the financial stability and strategic direction of the company. A thorough understanding of a firm’s innovation pipeline, leadership quality, and market positioning is crucial in evaluating its potential for long-term success. With high risk comes the potential for high reward, but it’s imperative to remain vigilant and informed, analyzing the market trends that could impact stock performance.

Market trends also play a critical role here. The integration of AI across various sectors, such as healthcare, finance, and retail, provides fertile ground for growth. But at the same time, these markets can experience significant volatility based on regulatory changes and shifts in consumer demand. Investors must monitor these dynamics closely to navigate the fluctuating landscape successfully. Diversification within AI investments, across different companies and sub-sectors, can mitigate individual stock risk while allowing for participation in broader industry growth.

Moreover, assessing a company’s market cap is another way to balance risk and reward. Smaller cap AI stocks might offer explosive growth potential due to their agility, but they come with greater volatility. In contrast, larger cap stocks provide stability but might deliver slower, albeit more assured, growth. Finding a mix that aligns with your risk tolerance and investment goals is essential to maximizing returns. By maintaining a diversified and well-researched portfolio, investors can position themselves to capture the upside while managing the downside risks inherent in investing in AI stock picks.

Evaluating the best AI stocks under $10 helps investors navigate market volatility.

Strategies to Minimize Risk While Investing in AI Stocks

Strategies for minimizing risk are essential when investing in the best AI stocks under $10.

Minimizing risk in AI stock investments involves a strategic approach that combines diligent research, diversification, and an understanding of market dynamics. Starting with comprehensive research, investors should focus on analyzing a company’s financial health, management team, and its position within the industry. A well-researched stock pick often indicates a company’s growth potential and its ability to withstand market disruptions. Diving into earnings growth trends, revenue stability, and innovation pipelines can provide insights into a stock’s investment viability. Investors should also evaluate the company’s adaptability to technological advancements and its commitment to sustainable practices as these factors significantly impact trading performance.

Diversification remains a cornerstone strategy to minimize investment risk. By spreading investments across various AI stocks, traders can mitigate the impact of any single stock’s poor performance. This means considering a mix of companies with different market caps and growth trajectories. While smaller AI firms under $10 might possess high growth potential, larger companies often provide more stability, thus creating a balanced investment portfolio. Additionally, integrating investments across multiple AI sub-sectors, such as data analytics, robotics, and natural language processing, further reduces risk by capitalizing on the broader industry’s diversified opportunities.

Diversifying within the best AI stocks under $10 can enhance investment stability.

Monitoring macroeconomic and industry-specific trends is critical. The AI sector is heavily influenced by advancements in technology and changes in consumer behavior. Investors should stay abreast of regulatory changes, particularly those related to data privacy and security, which could affect company operations and stock market performance. Engaging in periodic portfolio reviews, adjusting holdings based on evolving market trends, and being open to shedding non-performing stocks can enhance risk management strategies.

Finally, leveraging investment tools and resources tailored for AI markets can provide a competitive edge. These resources offer insights into the latest technological developments, peer analysis, and market forecasts, enabling more informed decision-making. Traders should also consider risk management techniques such as stop-loss orders to protect investments from drastic downturns. Employing these strategies, investors not only fortify their trading positions but also ensure they’re well-prepared to seize opportunities in a dynamic, high-growth market. By approaching AI stock investments with a methodical and informed mindset, investors can successfully navigate the complexities of risk and reward, aligning their strategies with the sector’s growth potential.

Practical Tips for Building a Diverse AI Stock Portfolio

Building a diverse portfolio of the best AI stocks under $10 is vital for investment success.

Crafting a well-rounded AI stock portfolio involves more than just looking at promising numbers. It requires a strategic blend of identifying high-potential AI stocks under $10 while understanding the broader market dynamics that influence their growth.

From harnessing the power of various tools and resources to conducting in-depth research on technology companies, it’s all about positioning for optimal earnings growth. We also explore how to leverage stock picks and adjust trading strategies in response to market trends, ensuring a balanced approach that adapts to changing conditions.

Tools and Resources for AI Stock Investment

Utilizing tools for the best AI stocks under $10 can streamline your investment approach.

Diving into the world of artificial intelligence stocks, especially those under $10, necessitates the right tools and resources to ensure you make informed investment decisions. For traders and investors, the journey begins with access to comprehensive market data platforms that provide real-time insights into the performance of AI stocks. These platforms often include detailed analytics on earnings growth, growth potential, and stock pick strategies. Platforms like TradingView offer intricate charting tools that help in visual analyses of stock performance, which is crucial when gauging a company’s historical traction and future potential.

Additionally, investment newsletters and financial journals are invaluable resources. They often highlight emerging technology companies within the AI sector, offering investor-centric insights into new trends and potential stock picks. Subscribing to sector-specific publications ensures you’re up-to-date with the latest AI advancements and how they may impact market movements. These resources can spotlight stocks with significant growth potential, tracking innovations that could redefine industry dynamics and fuel stock value enhancements.

Crowdsourcing platforms such as Motley Fool and Seeking Alpha allow investors to interact with fellow traders, sharing insights and strategies related to AI investments. The collaborative analysis can lead to discovering undervalued stocks or those with unexplored growth angles, expanding your horizon beyond conventional analysis. Forecasting tools and AI-driven simulators are also becoming popular, providing algorithmic predictions on earnings growth and potential market shifts based on historical data and emergent market trends.

Consider various resources to stay updated on the best AI stocks under $10 for informed decisions.

Furthermore, institutional insights such as those provided by hedge funds and investment banks add a layer of depth when evaluating artificial intelligence stocks. Their reports typically include sophisticated analyses, predictions, and sector comparisons drawn from vast datasets and advanced analytical models. Understanding these projections can help identify opportunities with a blend of small market cap stocks that offer agility and larger cap stocks with stable growth trajectories.

Lastly, don’t underestimate the power of a personal network. Engaging with industry veterans, whether through online forums or local investment clubs, can impart practical knowledge about effectively managing AI stock portfolios. They can offer firsthand experiences on navigating market volatility and recognizing impactful technological breakthroughs early on.

In essence, effectively leveraging a combination of digital tools, financial resources, and collaborative platforms not only enhances decision-making but also sharpens your trading acumen. By equipping yourself with these resources, you prepare not just to withstand market fluctuations but to capitalize on growth potential across the sprawling landscape of AI stocks. These tools don’t just guide you; they empower you to identify stock picks that align with your financial goals and risk tolerance, paving the way for a diverse and rewarding investment journey in the realm of artificial intelligence.

Networking with experts can provide insights into the best AI stocks under $10.

As AI continues to revolutionize industries, finding promising stocks under $10 could be rewarding for keen investors looking to enter the tech market without breaking the bank. With options spanning from emerging startups to innovative established companies, there’s potential for significant growth at an appealing price point. Remember, while these stocks offer an entry into the world of AI, conducting thorough research and considering financial advice tailored to your needs is crucial. Stay informed and regularly review your investment strategy to maximize your returns and navigate the evolving landscape of AI investments confidently.

Investors should focus on the best AI stocks under $10 to maximize their growth potential.

FAQs: Best AI Stocks Under $10

Understanding the best AI stocks under $10 is essential for navigating the tech market successfully.

What are AI stocks under $10, and why should I consider investing in them?

AI stocks under $10 are shares from artificial intelligence companies that are priced affordably. They’re particularly appealing to investors because they offer a budget-friendly entry into the rapidly growing AI sector, with significant growth potential driven by demand and technological advancements.

How can I analyze AI penny stocks for growth potential?

To analyze growth potential, focus on market trends and historical performance. Assess the company’s financial health, management quality, and its position within the tech landscape. Monitoring technological advancements and consumer demand shifts can also provide insights.

What role does market capitalization play in evaluating AI stocks?

Market capitalization helps determine a company’s size, market standing, and growth trajectory. Smaller cap stocks can offer high growth potential with volatility, while larger cap stocks provide stability, essential for balanced investment decisions.

What strategies can minimize risks when investing in AI stocks?

Minimizing risk involves thorough research, portfolio diversification, and staying informed about market trends and regulatory changes. Utilizing investment tools and setting stop-loss orders can protect investments from significant downturns.

What resources are recommended for staying updated on AI stock trends?

Use real-time market data platforms like TradingView for analytics, subscribe to financial journals for emerging trends, and participate in crowdsourcing forums such as Motley Fool for diverse insights. These resources help you stay informed and responsive to market shifts.