Liquidity is a key consideration for investors seeking quick access to cash or fluidity in their portfolios. When evaluating investment options like common stocks and cash investments, understanding which Investment has the most liquidity can significantly impact financial strategies. Common stocks, known for their tradability, offer varying degrees of liquidity, while cash equivalents generally provide the highest liquidity due to their immediate convertibility into cash. In this guide, we’ll explore which investments offer the most liquidity and how you can leverage these insights to optimize your investment choices for both responsiveness and profitability.

Key Highlights

- Liquidity defines how easily investments convert to cash without affecting market value.

- Cash equivalents ensure high liquidity and safety, crucial for emergency funds.

- Money market instruments offer competitive returns and are ideal for short-term investments.

- Bonds provide liquidity advantages and stability in volatile markets.

- Highly liquid assets aid in balancing immediate cash needs with long-term growth.

Understanding the Concept of Liquidity in Investments

Understanding liquidity is crucial for investors aiming to optimize their portfolios. Liquidity represents how easily an investment can be converted into cash without affecting its market value. It plays a pivotal role in financial decisions, guiding investors to balance risk and returns. The most liquid asset forms, such as cash and common stock, offer flexibility, especially during financial emergencies. Knowing which investments have high liquidity helps in creating a well-rounded investment strategy. By exploring liquid assets like savings accounts or checking accounts, investors can efficiently manage their funds and meet their financial goals with confidence and ease.

How Liquidity Impacts Investment Decisions

Liquidity significantly influences investment choices by affecting the ease and speed with which assets can be sold without causing market price disruptions. Market liquidity is crucial for investors seeking quick access to funds, particularly during economic downturns or emergencies. Having a portion of a portfolio in highly liquid assets like cash, stocks, or savings accounts enables investors to meet unexpected financial needs without incurring losses.

Liquid markets provide opportunities to buy or sell investments promptly, keeping trading friction low and rates competitive. The availability of efficient trading platforms further bolsters liquidity, allowing investors to diversify their investments while managing risks effectively. Balancing liquidity with growth prospects is essential. It ensures that while part of the portfolio is in fast-access liquid investments, other investments aim for higher returns over time. Therefore, understanding liquidity’s role can lead to smarter investment strategies that align with both short-term needs and long-term financial objectives.

The knowledge of how liquidity drives market conditions can help reduce stress for investors while enhancing the potential for financial growth. By keeping returns in focus, investors are better equipped to navigate the complex dynamics of financial markets.

The Role of Highly Liquid Assets in a Portfolio

Incorporating highly liquid assets into an investment portfolio is a strategic move for investors who value financial agility and stability. These assets act as a financial buffer, providing accessible cash during market volatilities or unforeseen expenses.

Instruments like common stocks and cash equivalents are considered excellent liquid investments, offering both flexibility and ease of access. Stocks have the advantage of being traded on liquid markets, ensuring that the conversion into cash is swift and involves minimal impact on the asset’s value. Furthermore, liquid assets help mitigate risks by offering a safety net, which is vital during economic instability. Utilizing checking accounts for daily liquidity needs or savings accounts for emergency fund reserves is a prudent strategy.

This approach ensures that the investment portfolio remains robust, catering to both immediate cash requirements and long-term growth ambitions. Effective use of highly liquid assets allows for quick recalibration of investment strategies, empowering investors to capitalize on market opportunities as they arise. By maintaining a balance between well-performing assets and those with high liquidity, investors can achieve a harmonious blend of security and potential for high returns. This method ensures a comprehensive financial strategy that addresses varied investor needs while optimizing investment outcomes.

Exploring Cash Equivalents as Highly Liquid Investments

Delving into cash equivalents gives investors an edge in creating a stable and liquid investment portfolio. Cash equivalents are highly liquid assets that can be swiftly converted into cash, providing reliable support in times of financial need. They bridge the gap between the higher returns of stocks and the immediate accessibility of cash. Investors often consider options like treasury bills and short-term CDs, which can offer better liquidity than some other asset classes. By understanding the unique features of these investments, investors can enhance their ability to manage cash flow effectively and support their financial goals with confidence.

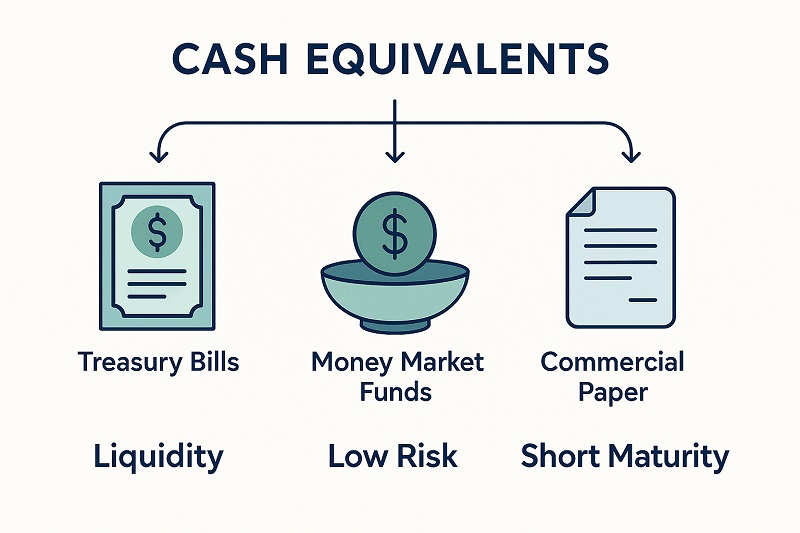

Key Characteristics of Cash Equivalents

Cash equivalents are prized for their easy conversion to cash and the high degree of safety they offer investors. These financial instruments often include money market funds, treasury bills, and commercial paper, each presenting unique benefits. With a focus on preserving capital, cash equivalents typically come with a lower yield compared to other investments, but they compensate with immediate liquidity. This is particularly useful for maintaining an emergency fund or managing unexpected expenses. The low risk and high liquidity of these assets make them ideal for those looking to park idle funds without locking them away in long-term commitments.

For traders and investors needing frequent access to funds, cash equivalents are valuable. They provide the balance of moderate returns while ensuring quick access to capital. Besides treasury bills and short-term CDs, money market accounts also qualify as cash equivalents due to their stable returns and high liquidity. Moreover, these accounts typically feature competitive interest rates, making them a favorable choice for those wanting a slightly better return than a standard savings account. As market conditions fluctuate, maintaining a portion of one’s portfolio in cash equivalents safeguards against volatility, offering predictability amidst the uncertainty of financial markets.

Comparing Cash and Cash Equivalents

While both cash and cash equivalents ensure liquidity, understanding their differences is crucial for effective financial management. Cash itself is immediately accessible and forms the core of liquidity in any portfolio. It’s the most liquid asset, with cash in savings or checking accounts offering instant availability. On the other hand, cash equivalents, while not physical cash, are liquid assets that can be quickly converted to cash, typically within 90 days. Thus, they provide a level of liquidity that lies between immediate cash availability and slightly higher returns.

A distinguishing feature is the rate of return. Cash equivalents often offer a higher return than cash due to their investment nature, though they still ensure liquidity is maintained. Accounts such as money market funds can sometimes yield better returns, making them attractive for those pursuing both safety and modest growth. It’s important for investors to assess how these elements fit within their larger investment strategy. Choosing between cash and cash equivalents involves analyzing market conditions, individual liquidity needs, and risk tolerance, ensuring each plays its part effectively in the portfolio.

By leveraging both cash and cash equivalents, investors gain a well-rounded approach to liquidity management. This dual strategy strengthens one’s ability to meet immediate cash needs while maximizing returns from liquid assets. Balancing these elements within a portfolio not only enhances financial flexibility but also prepares investors to respond swiftly to what the market dictates, turning liquidity challenges into opportunities for growth.

Overview of Money Market Instruments

Money market instruments are an essential component of liquidity-focused investment strategies. Known for their stability and low risk, they offer a practical solution for investors seeking highly liquid assets. These instruments provide competitive returns while maintaining market liquidity, making them ideal for short-term investments.

By including money market funds in your portfolio, you can efficiently balance risk and liquidity while accessing your funds quickly during financial emergencies. As you explore various accounts, such as savings and money market accounts, you’ll discover how these options can enhance the overall flexibility and security of your investments.

Advantages of Money Market Investments

Money market investments stand out for their combination of safety and liquidity, offering a haven for investors looking to preserve capital and access their funds swiftly. These highly liquid assets enable you to manage cash flow effectively, ensuring that your money is accessible when needed.

As a trader or investor, you appreciate the ability to move your assets without significant risk to market value, which is crucial for financial agility. Moreover, money market instruments often feature competitive interest rates, making them an attractive alternative to traditional savings accounts. By incorporating money market funds into your investment strategy, you can enjoy the dual benefits of steady returns and the ability to quickly adapt your portfolio to changing market conditions.

Another advantage is their low risk, providing peace of mind amidst market volatility. Money market instruments are typically considered safe investments, making them suitable for safeguarding your assets during uncertain financial periods. They serve as an ideal complement to more aggressive high-return investments, allowing you to balance potential growth with the security of liquid assets. Furthermore, money market accounts and funds offer a practical way to earn returns while keeping a portion of your portfolio ready for immediate needs or opportunities. By strategically leveraging these instruments, you can enhance your financial strategy, ensuring both stability and growth potential.

The Impact of Bonds on Investment Liquidity

Understanding the role of bonds in investment liquidity is crucial for any trader or investor. Bonds traditionally carry a reputation for being less liquid than stocks or cash equivalents. However, their impact on a portfolio’s liquidity shouldn’t be underestimated. While trading bonds might not boast the instant execution of stocks, certain types of bonds, especially those traded in established markets, can offer liquidity advantages. Government bonds, for instance, are frequently traded and generally provide more liquidity compared to corporate bonds. This can be particularly advantageous when market conditions are volatile.

Bonds serve as a stabilizer in investment portfolios, offering a predictable income stream through fixed interest payments. This trait appeals to investors seeking to balance their investments between growth and income. While not all bonds provide the same level of liquidity, understanding their individual market behavior is essential. High-grade corporate bonds and government bonds usually have better liquidity. They allow investors to tap into funds when needed, albeit with some market risk attached. The key is in selecting bonds that fit your liquidity needs without compromising your overall investment strategy.

Incorporating bonds into your investments also involves understanding their role during different market cycles. While they may not be the go-to choice for rapid liquidations, their stability during downturns offers strategic advantages. For traders focused on long-term stability, bonds provide a buffer against market fluctuations, reducing the stress of volatile trades. By mastering how bonds influence market liquidity, investors can build diversified portfolios capable of withstanding economic turbulence. So, whether you’re trading or investing, remember that bonds, despite their liquidity constraints, play a vital part in crafting robust, well-rounded investment strategies.

Investors looking to prioritize liquidity in their portfolios should focus on assets like common stock and highly liquid cash investments such as money market funds. These options can be swiftly converted to cash, providing flexibility and peace of mind in volatile markets. By balancing these liquid assets with other investments, you can create a robust strategy that caters to both immediate and long-term financial goals. Stay informed and consider consulting with a financial advisor to refine your investment choices, unlocking the potential for both growth and stability in your portfolio.

FAQ: Which Investment Has the Most Liquidity?

What is liquidity and why is it important for investors?

Liquidity refers to how quickly and easily an investment can be converted into cash without significantly affecting its market value. It is crucial for investors because it provides flexibility, helps in balancing risk and returns, and allows for quick access to funds during financial emergencies.

Which types of investments are considered highly liquid?

Highly liquid investments include cash equivalents, common stocks, money market instruments, and savings or checking accounts. These assets can be easily converted into cash, providing quick access to funds when needed.

How do cash equivalents differ from cash?

Cash is immediately accessible and is the most liquid asset. Cash equivalents, while not physical cash, are liquid assets that can be swiftly converted into cash, often within 90 days. They offer slightly higher returns than cash but maintain high liquidity.

What role do bonds play in portfolio liquidity?

Bonds provide a balance of stability and liquidity. While they might not be as liquid as stocks, certain bonds, like government bonds, offer reasonable liquidity and serve as a stabilizing force in volatile markets.

How can investors balance liquidity with growth in their portfolio?

Investors can balance liquidity and growth by maintaining a mix of highly liquid assets, like cash and money market instruments, alongside other assets that have higher return potentials. This strategy enables them to meet both immediate cash needs and long-term financial objectives.