Introducing your child to the world of financial planning can start with understanding custodial IRAs, a unique and powerful investment avenue designed for minors. This webpage delves into the essentials of investment accounts for kids, exploring how custodial IRAs can pave the way for a secure financial future. From understanding the basics to uncovering key benefits, we’ll equip you with insights to make informed decisions that align with your family’s financial goals. Dive in to learn how you can empower your child’s financial journey, offering them an early advantage in building wealth.

Key Highlights

- Custodial IRAs are designed for minors, offering tax advantages and compounding growth potential for retirement savings.

- Early financial education fosters skills in budgeting, investing, and saving, crucial for future financial responsibility.

- Popular investment accounts include savings accounts and Custodial IRAs, each catering to different financial goals.

- The Coverdell Education Account provides tax-free growth for education expenses, covering both school and college costs.

- Youth accounts teach budgeting and investing, preparing kids for financial independence with real-world financial skills.

Understanding Investment Accounts for Kids

Starting investment accounts for kids is a powerful way to ensure early financial education and security. While exploring various options, parents often look at accounts like brokerage and savings types tailored for youth.

These accounts allow families to save for future goals, whether they’re aiming for education savings or college savings funds. By understanding popular custodial accounts and their benefits, parents can make informed decisions about their child’s financial future. Plus, with the right planning, these investment accounts enable both parents and children to track money growth, fostering long-term financial literacy and responsibility.

Benefits of Early Financial Education

Introducing investment accounts for kids offers an array of benefits, particularly when it comes to early financial education. When children are engaged in the process of managing accounts, it paves the way for them to develop crucial monetary skills. These skills include budgeting, saving, investing, and understanding the value of money. It significantly impacts their ability to handle funds responsibly as they grow. Moreover, early exposure to financial planning sets a blueprint for achieving future goals, such as college savings or other education savings objectives.

For families, establishing a custodial account under options like UTMA accounts or a custodial brokerage provides a structured foundation for teaching kids about investments. These accounts simplify handling assets while emphasizing key financial principles, from tracking deposits and withdrawals to calculating interest and understanding the implications of saving versus spending. Additionally, with the flexibility of choosing between savings accounts or brokerage accounts, parents can cater to different financial strategies that align with their family’s needs and the child’s future goals.

Investing early allows children to benefit from the power of compounding. This concept, when explained and demonstrated through real-life account balances, can excite kids and motivate them to keep growing their money. Seeing savings increase over time not only encourages a commitment to regular contributions but also instills an understanding of long-term benefits, enhancing their grasp of important financial concepts as they mature. Furthermore, from an investor’s perspective, being informed about the potential scope of various investment accounts allows for better strategic planning and growth management.

By utilizing accounts specifically designed for young investors, such as custodial or youth accounts, families can actively involve their children in financial discussions. This engagement can build confidence and curiosity about complex financial matters, which are essential traits for future investors. It’s not just about meeting present financial needs but also preparing children for a lifetime of financial decision-making. In essence, the integration of these educational elements helps ensure the creation of savvy, responsible future custodians of wealth.

Popular Types of Investment Accounts

When exploring investment accounts for kids, several popular choices are available, each offering distinct benefits. These include savings accounts, brokerage accounts, and Custodial IRAs, all of which cater to different aspects of financial planning. Savings accounts, being straightforward, are ideal starting points for children, promoting regular saving habits through small deposits. The minimal risk associated with these accounts makes them a safe choice, allowing funds to grow steadily while teaching kids the basics of saving and interest accumulation.

On the other hand, brokerage accounts open up opportunities for simple investment strategies. They introduce children to stocks and bonds, expanding their understanding of the market. Under parental guidance, kids can learn about asset allocation and risk management, gaining insights into how investments can potentially yield returns over time. With tools like a custodial brokerage account, parents manage the investments until the child reaches the age of majority, at which point the assets are transferred for the child’s direct control.

Another noteworthy option is the Custodial IRA, primarily used to start retirement savings for minors. These accounts offer tax advantages, such as tax-deferred growth, making them effective for long-term financial planning. Starting a Custodial IRA also familiarizes children with retirement concepts early on. By contributing to this type of account, parents and children can see how consistent contributions can lead to significant retirement funds, highlighting the importance of early planning.

Integrating these different types of accounts, families can tailor their approach depending on what aligns best with their financial goals and the child’s future aspirations. Each type of account fosters distinct financial skills, from the fundamentals of saving with savings accounts to more sophisticated investing knowledge through custodial brokerage accounts. Involving children in these decisions helps solidify their understanding and appreciation of money management. Selecting the right mix of accounts will depend on the family’s financial objectives and desire to balance risk and reward while laying a solid educational foundation for the child’s financial future.

The Concept of a Custodial IRA

Understanding Custodial IRAs can open a new realm of opportunities for investing in your child’s future. Designed to help parents and guardians kickstart retirement savings for minors, these accounts combine financial growth with educational benefits. A Custodial IRA allows adults to manage contributions and investments until the child comes of age, aligning perfectly with long-term planning goals. With tax advantages and the potential for significant growth, Custodial IRAs serve as a strategic tool for families wanting to ensure financial security and teach young investors the nuances of saving for retirement.

How a Custodial IRA Works?

A Custodial IRA operates as a unique retirement account where the adult custodian manages the investments on behalf of the minor. The account might invoke curiosity because its structure intertwines a custodial account’s oversight with a retirement account’s growth potential. The custodian is responsible for making all decisions related to managing the account, whether it’s picking the right stocks or balancing risk with more stable investments. This empowers the adult to tailor the account to meet specific investment goals while providing insights into financial strategies that can be communicated and taught to the child.

You might wonder what’s distinct about a Custodial IRA apart from other youth-centric financial products. Unlike a typical brokerage account or savings account, a Custodial IRA focuses solely on retirement savings. Contributions made to this account are drawn from the child’s earned income, which means even summer jobs can contribute to significant future funds. Parents and families can then watch how even small contributions, thanks to compounding interest, can markedly increase over time. This offers practical lessons in financial management that teens and children can grasp relatively early.

The goal of setting up such an account often ties back to financial, educational, and retirement planning aspirations. Introducing minors to concepts like tax-deferred growth or retirement planning not only builds a financial foundation but also prepares them for real-world economic challenges. Seeing a custodial account balance grow through careful, planned contributions can instigate a profound understanding of money management and the future importance of retirement savings.

It’s a journey of financial discovery where families collectively explore the intersection of immediate financial education and long-term security. So, for parents considering how to bridge knowledge between saving and complex investments for their children, a Custodial IRA represents an intriguing and highly beneficial choice.

Eligibility and Contribution Limits

When delving into Custodial IRAs, understanding the eligibility criteria and contribution limits is essential in crafting a robust retirement plan for kids. A key element is the ‘earned income’ requirement: the minor must have some form of income to qualify for a Custodial IRA, setting the stage for even small jobs to contribute to future wealth. This condition not only encourages minors to engage in income-generating activities but also highlights the practical benefits of financial independence from an early age.

Contribution limits mirror those of traditional IRAs. For example, as of the current tax year, families can contribute up to $6,000 annually, or 100% of the minor’s earned income, whichever is lower. This cap fosters disciplined financial planning and strategizing on how to maximize potential benefits within these boundaries. Consequently, it’s a brilliant opportunity to teach children about maximizing retirement funds within legal constraints, instilling an understanding of tax laws, and the importance of saving.

The role of the custodian is crucial in navigating these aspects, ensuring that investments align with broader financial and retirement planning objectives. It becomes an educational journey as families make decisions about where funds should go, whether into conservative bonds or more aggressive stock market options. Having these discussions instills a deeper understanding of financial concepts like risk assessment, diversification, and the long-term nature of investing.

Moreover, involving teens in these discussions can be empowering. As they learn the ropes of financial responsibility, they’re better positioned for future tasks like planning for college savings or even launching personal investment ventures. The transfer of account control at the age of majority symbolizes a shift in responsibility, equipping young adults with the tools they need to be effective financial stewards.

Incorporating Custodial IRAs into family financial discussions not only addresses immediate retirement planning but also aids in fostering a culture of forward-looking investment. In the bigger picture, this approach not only prepares children for tangible financial tasks but also ensures a smoother transition to adulthood, financially savvy and ready to invest boldly.

Choosing the Right Investment Accounts

Selecting the right investment accounts for kids can be pivotal in setting a solid financial foundation. It’s about understanding the diverse array of options like custodial IRAs, savings accounts, and brokerage accounts. Each option offers unique benefits tailored to the long-term growth and financial literacy of young investors. By comparing these options, families can align them with their child’s future goals, managing contributions to foster a comprehensive understanding of financial planning. With the right approach, these accounts don’t just secure funds for the future but also nurture children’s understanding of money management early on.

Comparing Custodial IRA with Other Options

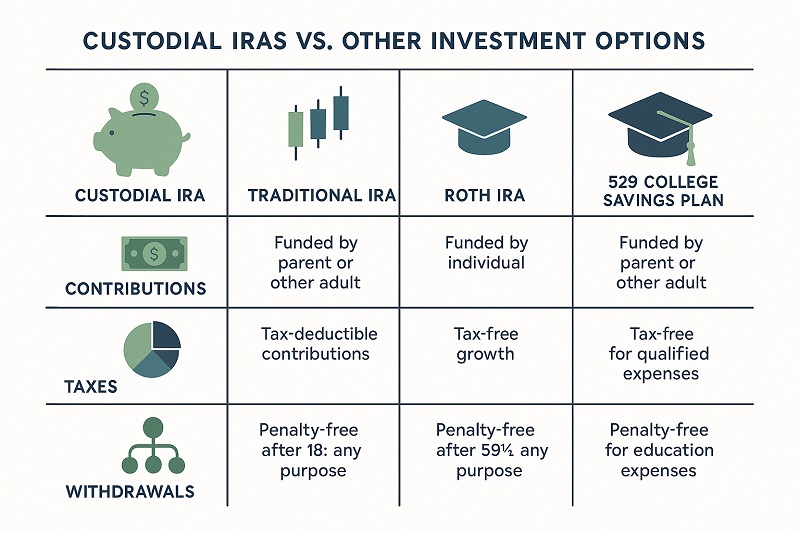

When diving into investment accounts for kids, parents often weigh the benefits of a Custodial IRA against other popular options, such as UTMA accounts and savings accounts. A Custodial IRA is distinct in its focus on retirement savings, offering tax-deferred growth that can be especially beneficial for minors starting with even small earned incomes. This account type encourages early investing, helping children comprehend the long-term nature of financial planning. By starting contributions from a young age, kids and their families can witness firsthand how patience and consistent savings efforts can lead to significant asset growth over time.

On the other hand, savings accounts offer a more straightforward introduction to financial management. They’re the classic choice for families aiming to instill regular saving habits without the complexities of market fluctuation. Despite offering relatively low returns, savings accounts allow children to understand the principle of interest and the steady growth of funds in a safe environment. They fall short, however, in providing the dynamic learning opportunities that come with investing in a Custodial IRA, where market interactions and strategic decisions are a routine part of the learning curve.

Comparing these to UTMA accounts provides another angle; UTMA accounts can hold a variety of asset types, not limited to just cash or retirement funds. These accounts allow for greater flexibility, granting teens access to a broad spectrum of investment experiences. Families can choose to hold stocks, bonds, or other property within these accounts, teaching asset diversity and risk management. However, they lack the retirement focus that a Custodial IRA provides, primarily driven by tax advantages designed to maximize retirement savings.

The decision between these accounts often boils down to the goals set by the family. If the primary aim is to educate about retirement planning early, then a Custodial IRA stands unmatched with its particular focus. But for general financial education in asset management and savings principles, a combined strategy leveraging savings and UTMA accounts may be beneficial. These collectively offer a structured landscape for kids to learn about personal finance, with each account playing a specific educational role. Ultimately, it’s about crafting a balanced approach that nurtures financial literacy while setting the stage for future investment endeavors. Encouraging open discussions around these accounts allows children to actively participate and ask questions, turning these learning moments into valuable life skills through practical application and observation.

Long-term Growth Potential for Kids

Understanding the potential for long-term growth is central to choosing the right investment accounts for kids. A Custodial IRA, for example, is uniquely positioned to leverage the benefits of compounding interest over many years. Starting early with such an account encourages kids to cultivate a mindset oriented toward the future. It’s not just about the immediate financial education; these accounts are pivotal for instilling a sense of delayed gratification and long-term planning. Kids who see their accounts grow over time with contributions like birthday money or earnings from part-time jobs can truly appreciate how disciplined financial habits pay off in substantial ways.

Investing within a Custodial IRA tailors well to teaching children about retirement plans while expanding their financial competencies. The tax advantages offered by this type of account mean that investment gains aren’t taxed until withdrawal, typically years in the future. For kids and their families, this translates into maximizing their investment potential over the child’s youth and into adulthood. Observing this tax-advantaged growth provides tangible lessons on financial strategies like tax planning and leveraging tax-deferred accounts for optimal financial health.

Brokerage accounts add another layer of complexity, exposing children to direct market investments with the aid of a custodial guardian. These accounts introduce kids to investment vehicles like stocks and bonds under parental guidance. Viewing market fluctuations in real-time and experiencing the ups and downs firsthand can bolster a child’s understanding. This hands-on experience is invaluable and can spark an early interest in investment strategies, risk management, and portfolio diversification.

Furthermore, highlighting the importance of balancing safe investment with calculated risk can encourage children to become more engaged investors. As they come of age and gain full control over their accounts, they’re likely to carry forward the strategies they’ve learned, applying them to future financial decisions. The journey of watching funds grow over time, understanding that growth isn’t instantaneous but a result of informed decisions and patience, lays a sturdy foundation for healthy financial attitudes that persist into adulthood.

Families seeking to ensure the long-term financial security of their children through investment accounts should remain open to discussing the implications of each account type. Whether selecting a Custodial IRA for its retirement focus or a brokerage account for diverse asset exposure, these decisions highlight the intricate balance of gearing kids toward financial independence while ensuring they’re armed with the knowledge to handle their future wisely. In doing so, they are better prepared for life’s financial responsibilities, establishing a clear path to achieving both short-term goals and securing a prosperous future.

Integrating Savings Accounts for Beginners

Getting kids started on the right path to financial literacy can be a game-changer, especially when integrating savings accounts into their financial education. Savings accounts are pivotal tools for families looking to instill a sense of saving and budgeting in young minds. They offer a secure, low-risk method to teach children about managing money and understanding the importance of regular contributions. By opening a savings account, parents can introduce concepts like interest accumulation and the importance of consistent saving habits. This step is often a gateway to broader financial planning, helping children become future-ready by understanding funds and investment strategies right from the get-go.

Understanding the Role of Savings Accounts

As a trader and investor, you know the value of starting financial education at a young age. Savings accounts are instrumental in introducing children to the world of financial planning. These accounts aren’t just about storing money; they’re about teaching kids the foundational skills they’ll need once they dive into more complex financial waters. For families, savings accounts offer more than just a safe place to keep money, they’re also gateways to financial understanding. They help children become familiar with the basic concept of interest, learning that the more funds they save, the more money they’ll have over time due to the accumulation of interest. This is a crucial step before transitioning to more sophisticated accounts like custodial IRAs or youth accounts focused on long-term goals.

The simplicity and security of savings accounts make them perfect for young savers still learning the ropes of financial ownership. They allow for discussions around money management without the complications of investment volatility. For parents, it’s a golden opportunity to combine financial education with practical application. By exploring the differences between types of accounts, families can align their financial strategies more closely with personal goals. Integrating lessons about regular contributions helps children see firsthand how small, regular actions can lead to significant funds over time, a lesson valuable in trading as well as personal growth.

Moreover, having a proper grasp of how savings accounts function can build a child’s confidence and readiness for more complex investment decisions later. Learning about budgeting and planning through the maintenance of these accounts ensures children understand their financial landscape, equipping them for the introduction of higher stakes financial products when they’re teens or young adults. The idea is for these early lessons to breed a culture of saving and planned spending, a bedrock of good financial practice.

Savings accounts also serve as a form of shorthand introduction to the world of financial planning, bridging the gap between simple money management and comprehensive strategies involving contributions and planning. Parents can choose accounts that have low fees or encourage regular deposits through incentives, making it easier to teach kids the value of smart banking practices. The conversation about savings accounts is, therefore, not just about protecting money but about investing in a child’s financial literacy. When chosen wisely, these accounts help develop insight into the power of money and the importance of making informed choices about their financial futures.

Crucially, opening a savings account involves simple yet crucial steps like acquiring a social security number and setting a child as the beneficiary. It’s a straightforward process that integrates a child into personal budgeting and financial awareness. As these young savers grow into their roles as investors, starting with the secure, stable platform of a savings account ensures they’re not just preparing for future savings but also investing in their financial independence. As a trader looking to equip the next generation, encouraging the use of savings accounts among children provides them with the plantation to nurture a lifetime of responsible financial habits.

Exploring Coverdell Education Savings Plans

The Coverdell Education Savings Account (ESA) is a key tool for families looking to invest in their child’s educational future. These accounts provide an attractive pathway to save specifically for education expenses, offering various financial benefits along the way. Coverdell ESAs, often referred to as education savings accounts, allow families to make contributions that grow tax-free. This account type ensures the funds are available for a range of educational costs, from grade school expenses to college savings. As part of your investment strategy, understanding how Coverdell ESAs function can significantly enhance your financial planning for your kids’ education.

Benefits of a Coverdell Education Account

Navigating the landscape of education savings, the Coverdell Education Account offers distinct advantages worth exploring, especially for families keen on financial planning tailored towards their child’s educational journey. One of the primary benefits of a Coverdell Education Account is its tax advantage; contributions grow tax-free, and withdrawals are tax-exempt if used for qualified education expenses. This means any earnings from investments within the account are shielded from taxes, maximizing the growth potential of the funds saved. As an investor looking to leverage this, focus on ensuring contributions are maximized early to take full advantage of compounding interest over the years.

Another considerable perk of the Coverdell ESA is its versatility in covering a wide range of educational expenses beyond higher education, including elementary and secondary school costs. This flexibility makes it a robust choice for families who want a comprehensive strategy for covering educational expenses at different stages of their child’s academic journey. Whether it’s tuition, books, or even expenses for special needs services, a Coverdell Education Account provides a devoted financial cushion. From the perspective of long-term investment, it allows for highly targeted financial planning.

Moreover, the account places the power of market investments within reach by permitting contributions to be invested in stocks, bonds, or mutual funds. This investment-oriented approach not only aids in growing the funds but also serves as a financial education tool, teaching both parents and children about the dynamics of investing. Parents can use this hands-on experience to explain market principles and the significance of strategic investment decisions, incorporating valuable lessons on risk assessment and portfolio diversification.

Families who prioritize contributions to a Coverdell Education Account also facilitate the investment conversation early, encouraging children to understand and participate in financial decisions. This proactive engagement sets a strong foundation for financial literacy, highlighting the impact of disciplined savings and strategic investing. Setting a future-focused narrative, involving your child in managing these funds can spark curiosity and understanding about financial systems, creating savvy future investors.

Finally, the Coverdell ESA melds seamlessly into existing savings strategies like savings accounts, creating a holistic approach to finance management. By aligning an ESA with current financial tools, families can optimize their investments, ensuring that funds held in savings accounts also contribute effectively to the broader goal of education savings. This dual strategy reaffirms the goal of providing for educational expenses while maintaining open lines for other potential investment opportunities, crucial for well-rounded financial planning. Embracing Coverdell Education Accounts reinforces the importance of planning and investing in your child’s future, paving the way for academic success and financial independence.

Introducing Youth Account Options

Opening investment accounts for kids provides a platform for instilling financial literacy from an early age. Empowering children with the know-how to manage money through accounts like youth accounts and custodial accounts can set a foundation for lifelong financial responsibility. As parents explore these options, they can teach kids the value of budgeting, saving, and investing, which are core to financial literacy. By choosing the right investment account, families can guide their children through the intricacies of financial planning, making informed decisions about contributions and savings strategies that support future goals.

Building Financial Responsibility in Kids

Building financial responsibility in kids is a rewarding journey that begins with the right financial tools. Setting up a youth account, such as a custodial account, is a practical step for instilling financial habits early. These accounts turn abstract lessons into hands-on experience, making concepts like contributions, saving, and investing tangible for kids. When a child is named as a beneficiary on these accounts, it creates a real sense of ownership and accountability for their funds, teaching them about the responsibilities that come with money management.

One of the key benefits of establishing a youth account is the opportunity to teach budgeting. As kids begin to understand how money flows in and out of their accounts, they’re also learning to plan for their needs. They witness firsthand the results of their saving efforts, whether it’s saving up for a new toy or setting aside money for a bigger goal like college. This early proficiency in budgeting lays a strong foundation for their financial independence as they grow into teens and adults.

Further, engaging kids with a custodial account broadens their perspective on investments. With guided support from parents, children can start to explore basic investment principles. Families can introduce age-appropriate discussions about risk and reward, showing the potential of their funds growing through smart investment decisions. A custodial brokerage account might serve as an educational tool where kids can learn about the stock market, bond investments, and the importance of diversification along with the broader financial market concepts.

To make these lessons even more impactful, parents can encourage regular contributions to these accounts. It might seem trivial, but even small contributions can accumulatively teach kids about the value of consistency in building financial wealth. These contributions, ideally documented and discussed regularly, reinforce the concept of sustained saving over immediate spending.

Moreover, integrating financial planning discussions into family routines makes economic education a part of daily life. By involving kids in straightforward decisions about their savings accounts or minor investment choices, they learn firsthand the critical thinking and analytical skills needed for effective financial planning. Over time, these interactions develop into a cultivated interest and adeptness in financial matters.

Encouraging your child to participate in monitoring their custodial account can further enhance learning. They’ll not only watch their funds grow due to savings but they’ll also get intrigued by the mechanics of gains or losses in an investment scenario. Discussing these updates nurtures a thoughtful approach to money management and equips them to ask insightful questions, spurring a deeper curiosity about economic systems.

The broader aim is preparing kids to become financially self-sufficient and prudent with their wealth. Selecting the right mix of savings and investment accounts empowers these young beneficiaries to appreciate the balance between enjoying their resources and saving for the future. Parents and families can reflect on this investment in their child’s financial education as a pivotal step towards creating savvy, responsible future investors. By actively participating in this journey, kids develop a comprehensive understanding of financial landscapes, ready to manage their financial journey as they transition into adulthood.

Opening a custodial IRA for your child is a forward-thinking decision that sets the foundation for their financial future. With the potential for tax advantages and compounded growth, you’re not only introducing them to the world of investing but also teaching invaluable life lessons in financial literacy and responsibility. Whether it’s a Roth or Traditional option, the benefits could significantly aid in their long-term wealth-building journey. Embrace transparency by engaging your child in investment discussions to harness these opportunities fully. Explore the possibilities today and empower your child for tomorrow.

FAQ: Investment Accounts for Kids

What is a Custodial IRA and how does it benefit minors?

A Custodial IRA is an investment account designed for minors that offers tax advantages and compounding growth potential. This account is managed by a custodian until the child reaches the age of majority, allowing for significant retirement savings to be built over time starting from small earned incomes.

How do Custodial IRAs differ from other youth accounts like savings accounts and UTMA accounts?

Custodial IRAs focus on long-term retirement savings with tax-deferred growth, drawing contributions from the child’s earned income. In contrast, savings accounts offer a safer, straightforward way to teach children about savings and interest, while UTMA accounts can hold a variety of asset types, allowing for broader investment exposure.

Why is early financial education important for children?

Early financial education instills skills in budgeting, saving, and investing, thereby fostering financial responsibility. By engaging children in managing their accounts, they learn crucial monetary principles that will aid them as they handle funds responsibly throughout life.

What is the role of parents in managing and educating about Custodial IRAs?

Parents act as custodians of the IRA, making decisions on investments and contributions. They play a crucial educational role by involving their children in discussions about financial planning, risks, and strategic decisions, thereby fostering a deeper understanding of financial management.

What is a Coverdell Education Savings Account, and how does it support educational expenses?

A Coverdell ESA allows families to save for education expenses with tax-free growth. Contributions may be invested in stocks, bonds, or mutual funds, with the funds available for costs ranging from grade school to college. This offers a tax-advantaged way to manage educational savings effectively.