Imagine standing on the edge of history, where the very ground beneath your feet holds the power to rewrite fortunes and secure America’s energy dominance for generations. This isn’t science fiction. This is the reality unfolding right now through a bold public auction scheduled by March 31. Our government is offering rights to an area the size of France and Germany combined—245 million acres of American heartland territory. It’s a 1,000% opportunity rubber-stamped by Google, Meta, Shell, and even the White House itself.

If you’ve ever dreamed of aligning your investments with the smartest, most connected energy insiders on the planet, this is your moment. Whitney Tilson, the visionary editor of Commodity Supercycles, has laid out the entire roadmap in his groundbreaking research. By subscribing to Whitney Tilson’s Commodity Supercycles today, you gain immediate access to exclusive reports that name the companies poised to ride this wave to extraordinary wealth. This isn’t hype—it’s inspiration backed by America’s timeless tradition of turning land into legacy.

The Strange New Map That Changes Everything

Take a moment and picture this strange new map of America, compiled by the Bureau of Land Management—the very agency entrusted with millions of acres of public land on behalf of every American citizen. This map isn’t just lines and colors. It’s the key to the biggest wealth-building opportunity you’ll see all year.

Our government is selling off rights to vast stretches of this land to powerful companies ready to generate millions—actually trillions—in value. This land belongs to you as an American, yet only those who act swiftly will claim their share of the profits. The next auction closes by March 31, and everything you need to stake your claim is waiting inside Whitney Tilson’s Commodity Supercycles.

Energy giants and billionaires are already circling: Ray Dalio, John Arnold (the legendary natural gas trader), insiders at Devon Energy (pioneers of fracking), Chevron, Google, Meta, Berkshire Hathaway, Jeff Bezos, Bill Gates, and Mark Zuckerberg. They see what’s coming—an “awesome resource” that President Trump’s inner circle has championed. It’s not nuclear, fusion, solar, wind, gas, or oil. It’s a radical new form of energy that has insiders calling it the “Holy Grail” breakthrough and a “game-changer” for our future.

The International Energy Agency, ARPA-E (the advanced research arm of the Department of Energy), and even The Economist have weighed in with staggering endorsements. Capture just 0.1% of the energy packed into this resource, and the impact is transformative. McKinsey analysts project a 1,000% trend worth more than a trillion dollars.

This is where Whitney Tilson’s Commodity Supercycles shines. His team has connected every dot, from the map to the companies ready to profit. Subscribe now, and you’ll receive his special reports free—reports that hand you the exact names and strategies to participate before the March 31 deadline passes.

America’s Timeless Strength: Wealth Built From the Land

America’s greatness has always sprung from its land. Timber, gold, silver, oil, and fertile farmland didn’t just build fortunes—they built the richest, most powerful nation on Earth. Whitney Tilson reminds us that the richest Americans in history understood this truth intimately.

Consider Leland Stanford. Federal land grants signed by Abraham Lincoln helped him build the Central Pacific Railroad. He flipped unused portions to settlers and developers, amassing wealth that endowed Stanford University, created a horse-racing empire, and funded a Gilded Age mansion rivaling the Astors. His story inspires us: vision plus land equals generational legacy.

George Hearst rose from dirt-poor Missouri frontier roots to head one of America’s wealthiest dynasties. He struck one of the richest silver deposits in U.S. history and owned one of the largest, deepest gold mines in North America—all on federal lands. His empire of influence and fortune stands as a beacon of what bold action on public land can achieve.

Then there’s J. Paul Getty. In 1915, he invested just $500 for a half-interest in a federal oil lease in Oklahoma. That single move grew into Getty Oil and a net worth exceeding $6 billion. These legends didn’t wait for permission—they seized opportunity when the government opened the door.

Today, a new chapter is being written in front of our eyes. Once again, the land—legally yours as an American—promises trillions in value. But only a handful will profit. Whitney Tilson’s Commodity Supercycles exists precisely so you can be one of them. His inspirational research shows you how to ally your money with the smartest energy insiders alive. Subscribe today and step into this living history.

America’s Last Energy Revolution: The Shale Boom That Changed the World

To understand the magnitude of what’s coming, roll back the clock more than a quarter century to a man who refused to accept limits. His name was George Mitchell. Working in Texas oilfields since before World War II, Mitchell built a thriving company only to watch it nearly die as conventional deposits dried up.

With his back against the wall, he pursued an idea everyone called crazy—including his own executives. For 17 long years, facing ridicule, he searched for a way to crack shale rock and release trapped oil and gas. In 1997, the “aha moment” arrived. His team succeeded. Mitchell sold his company for $3.5 billion, and his innovation—the very technique that ignited America’s shale boom—turned the nation into the world’s #1 oil producer.

The Financial Times hailed it as “the innovation of the century.” Sleepy towns like Williston, North Dakota, exploded: population doubled in a year, roads jammed with trucks, home prices soared past Manhattan levels. Investors who backed early adopters reaped life-changing gains. EOG Resources (the “Apple of Oil”) rose more than 1,000%. Continental Resources climbed from under $10 to over $70. Southwestern Energy delivered 37 times returns. Brigham Exploration multiplied sixfold before a $4.4 billion buyout.

Whitney Tilson shares this story not as nostalgia, but as prophecy. History is repeating itself—bigger, bolder, and more accessible than ever. The same technology that unlocked shale now unlocks something even greater. Subscribe to Commodity Supercycles and position yourself at the forefront of this new revolution, just as early shale investors did.

The Next Energy Breakthrough That Will Dwarf the Shale Boom

We stand on the brink of a new all-American energy revolution. This time, it’s not about extracting finite fuels. It’s about using the land itself to generate almost unlimited energy—anywhere, anytime, forever.

This breakthrough is called Enhanced Geothermal Systems, or EGS. It’s the “Holy Grail” of energy, a “game-changer,” the next “zero-carbon hero.” The Department of Energy calls it a “50-State Solution” because every state—from California to New York, Texas to North Dakota—can tap it. Unlike shale (limited to a few states), coal, gas, uranium, solar, or wind, this resource exists everywhere: near data centers, hospitals, factories, military bases.

There’s no limit on how much we can use. It never runs out. It’s baseload power—always available, even in extreme weather. No toxic waste, no intermittent supply. It runs on water. And ironically, it depends on the very drilling technology perfected during the shale boom. Oil and gas companies aren’t fighting it—they’re embracing it as “the smokin’ hot trophy wife of the oil and gas industry.”

We won’t need decades or billions to build plants. Existing rigs and abandoned sites can be repurposed quickly. Global investment is racing toward $3 trillion. The Department of Energy’s “Earthshot” program is accelerating development with the goal of powering up to 65 million American homes. America already leads the world—far ahead of China, Russia, Europe, or Saudi Arabia. Both sides of Congress, President Trump, and Secretary of Energy Chris Wright love it. Billionaires Warren Buffett, Bill Gates, and Richard Branson are on board.

This could power the AI explosion, reduce dependence on foreign oil, and strengthen national security. It’s bigger than shale, bigger than nuclear, bigger than oil itself. Whitney Tilson’s Commodity Supercycles delivers the full inspirational blueprint so you don’t just watch history—you profit from it.

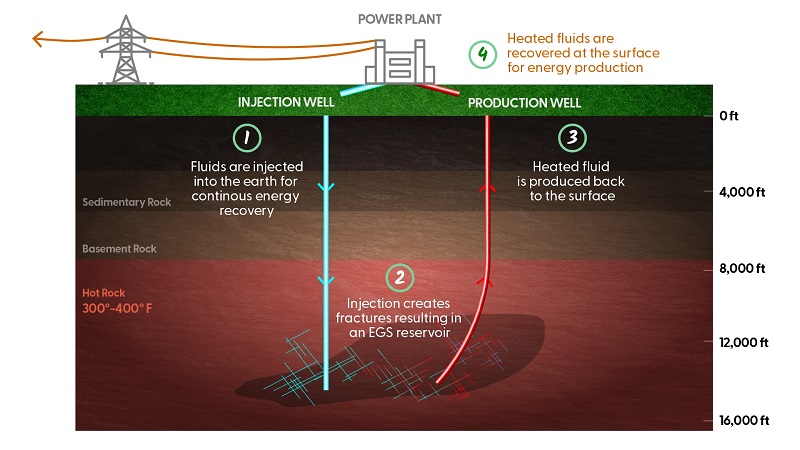

How Enhanced Geothermal Systems (EGS) Actually Works

The beauty of EGS lies in its elegant simplicity, made possible only recently by shale-era innovations. Deep beneath our feet, Earth’s core burns at over 10,000°F—hotter than the sun—generating heat equivalent to 30,000 nuclear plants running full tilt. Traditionally, we could only tap this in volcanic spots like Iceland or Hawaii.

Now, thanks to advanced drilling, we can access it anywhere. Drill 2 to 6 miles down into hot, hard rock (around 400°F). Inject high-pressure water. The water heats up as it flows through the fractured rock, then returns to the surface to drive turbines and generate electricity. Take an old oil or gas well, repurpose it, and you’re mining clean, limitless heat.

Vik Rao, former chief technology officer at Halliburton, captured the excitement perfectly. One EGS CEO summed it up: this isn’t some fringe renewable—it’s practical, scalable, and ready now. No unreachable tech goals. No endless scans. Just drill deep enough, and access is yours. This is the technology that has Whitney Tilson flying film crews to remote Utah deserts to show you the action firsthand.

Three Powerful Triggers Igniting the EGS Wealth Explosion

What makes Whitney Tilson so certain this will create extraordinary wealth? Three unstoppable catalysts, each stronger than the last.

Trigger 1: Full Throttle Government Backing The entire U.S. Department of Energy is all-in. Their “Earthshot Initiative” aims for a potential 90% cost reduction by 2035. Secretary of Energy Chris Wright has ramped up support, signing orders naming enhanced geothermal as a national priority. Because EGS borrows directly from shale technology, oil and gas workers and rigs can pivot seamlessly. The most powerful “energy boss” in America deeply wants EGS to succeed—and that momentum is unstoppable.

Trigger 2: Exploding AI Energy Demand AI data centers—1,240 already completed or under development—each consume as much power as a small city. Energy shortages, blackouts, and skyrocketing prices loom unless new baseload sources arrive fast. Nuclear takes a decade; EGS scales quicker using existing equipment. That’s why Google, Microsoft, Meta, and Amazon are signing massive geothermal deals. The same forces that drove 800% nuclear stock surges are now flooding into EGS. Early movers are already seeing explosive gains.

Trigger 3: Record-Breaking Land Auctions After filing FOIA requests, Whitney Tilson uncovered proof: the Bureau of Land Management is leasing record amounts specifically for geothermal—especially EGS. In late October last year, Utah alone offered 64 leases covering 218,000 acres—more than double the prior year. Bidding was so intense, revenue spiked eightfold. Insiders are snapping up sites at a fever pitch. This is the clearest signal of a boom you’ll ever see, and it’s happening in the very Black Desert locations Tilson’s team visited.

These triggers create the perfect storm. Smart money is moving first to pure-play companies at the heart of EGS innovation.

Fervo Energy: The Pioneer Leading the Charge

At the center stands Fervo Energy. Just like George Mitchell pioneered shale, Fervo is pioneering the advanced drilling that makes EGS reality. Their Project Red in Nevada set records. Then came Cape Station in Utah—slashing drilling times by 70%, reaching hotter rock faster. The Bureau of Land Management just approved a massive project there capable of 2 gigawatts—enough to power all homes in Chicago, Houston, or Los Angeles from less than one square mile. Compare that to 36 million solar panels or 588 wind turbines!

Fervo boasts backers from every corner: Devon Energy (the firm that bought Mitchell’s company), Breakthrough Energy Ventures (Bill Gates), Berkshire Hathaway Energy (Warren Buffett), California Teachers Pension Fund, Canada Pension Plan, Liberty Mutual, Google, and more. Fervo unites oil expertise, green innovation, and limitless renewable power. Though private, it points the way for public companies ready to scale.

Your Roadmap to Profits: Exclusive Reports Inside Commodity Supercycles

Whitney Tilson has spent months identifying the very best ways for everyday investors to ride this wave. He’s prepared three special briefings available only to Commodity Supercycles subscribers:

- Limitless Energy: Four Stocks That Could Power America for 30,000 Years — Pure-play EGS leaders with massive focus and specialty. As awareness grows, these will become Wall Street “must-owns,” delivering multiples like the early shale winners.

- Water, Land, & Steel: Four “Pick and Shovel” Plays for the Coming EGS Revolution — Companies supplying high-pressure equipment, land with existing infrastructure, and direct investments in Fervo-style projects across Nevada, Utah, California, and beyond. With 218,000 acres already auctioned in Utah alone—and more coming—the infrastructure boom is guaranteed.

- Backdoor Blue Chips: The Major Players Who Can Help You Get Your Feet Wet — Established giants with growing EGS exposure. Lower risk, perfect for complementing pure plays or starting conservatively.

These reports are not sold anywhere else. They contain ticker symbols, buy details, and in-depth analysis.

Subscribe to Whitney Tilson’s Commodity Supercycles and download them instantly.

Why Whitney Tilson and Commodity Supercycles Are Your Trusted Guide

After running a $200-million hedge fund and tripling clients’ money, Whitney Tilson joined Stansberry Research—one of the most respected names in financial publishing with over a million followers worldwide. Wall Street legends like Bill Ackman, Joel Greenblatt, David Einhorn, Leon Cooperman, and Seth Klarman subscribe to his work.

His track record inspires confidence: calling the 2008 market bottom on 60 Minutes, predicting the dot-com bust in 2000, recommending Netflix at $7.78 (now up over 1,050%), and urging investors to buy McDonald’s after a 70% drop (shares rose 14 times). Commodity Supercycles itself delivered standout returns: 264% on Kaminak Gold, 321% on Jinshan Gold Mines, 339% on Silver Wheaton, and an average 25% in 2025.

Every month, you receive deep analysis on energy and resource opportunities. The model portfolio, full archive, and updates are available 24/7 on the members-only site. This is the same research that helps billionaires stay ahead.

Everything You Receive When You Subscribe Today

Click here and enjoy a special introductory no-risk trial. Usually $499 per year, but you get immediate access at a generous discount. You’ll receive:

- 12 monthly issues of Commodity Supercycles (delivered the second Monday of each month) packed with recommendations and market analysis.

- All three special briefings on EGS stocks, pick-and-shovel plays, and blue chips.

- Full model portfolio with around-the-clock access.

- Complete archive and real-time updates.

If you’re not thrilled in the first 30 days, call customer service for a 100% full refund—no questions asked. You risk nothing. You gain everything.

Your Invitation to Join the Energy Revolution

This is more than an investment. It’s your chance to participate in America’s next golden era of energy independence and economic strength. Picture your portfolio growing as EGS powers AI, secures our grid, and reduces foreign dependence. Picture telling your family you acted when the opportunity was still early—just like Stanford, Hearst, Getty, and Mitchell’s early backers.

The March 31 auction deadline looms. Insiders are moving fast. Don’t let this 1,000% opportunity pass you by. Whitney Tilson has done the work—flying crews to Utah, filing FOIAs, connecting every thread—so you don’t have to.

Subscribe to Commodity Supercycles right now. Download your reports instantly. Join an elite community that understands how massive shifts create massive wealth. America’s land is calling. The energy revolution is here. Your future of financial freedom and inspirational prosperity starts with one simple click: “Get Started Now.”

Welcome to the winning side of history. We can’t wait to see the extraordinary returns you achieve.

FAQ: Whitney Tilson’s EGS Boom & Commodity Supercycles

What exactly is the EGS breakthrough Whitney Tilson is highlighting?

Enhanced Geothermal Systems (EGS) represent a game-changing advancement in clean, limitless energy. By drilling deep into hot rock formations (using technology pioneered in the shale boom), injecting water to create heated reservoirs, and generating electricity from the steam—EGS unlocks Earth’s internal heat anywhere in the U.S., not just volcanic regions. It’s baseload power (always on, 24/7), zero toxic waste, runs on water, and could power America for thousands of years. Whitney Tilson calls it the “Holy Grail” energy source—a 50-state solution bigger than the shale revolution, backed by the Department of Energy’s Earthshot Initiative, Secretary Chris Wright, Google, Meta, Shell, Berkshire Hathaway, and more.

Why is there a “1,000% profits” opportunity in geothermal/EGS right now?

McKinsey analysts describe it as a 1,000% trend potentially worth trillions. With exploding AI data center demand (1,240+ centers needing city-scale power), government support, record BLM land auctions (e.g., 218,000 acres in Utah with 8x revenue spike), and oil/gas firms pivoting rigs to EGS, early investors in pure-play companies could see massive multiples—like the 1,000%+ gains from EOG Resources or Continental Resources during the shale boom. Whitney Tilson’s research identifies four direct EGS stocks, pick-and-shovel plays (equipment/land), and blue-chip backdoors to capture this before mainstream awareness hits.

What is the March 31 public auction, and why does it matter?

The U.S. government (via the Bureau of Land Management) is auctioning rights to millions of acres of public land—equivalent to France + Germany combined—for geothermal/EGS development. The deadline referenced in Whitney’s presentation was March 31 (in the original pitch cycle), signaling urgent insider buying. These auctions have exploded in scale, with intense bidding from energy giants and billionaires. Acting fast lets you align with the “smart money” profiting from America’s land-based wealth tradition (like Leland Stanford, George Hearst, and J. Paul Getty did historically).

Who backs this EGS opportunity, and why should I trust it?

Heavy hitters include: Google and Meta (signing geothermal deals for data centers), Shell, Chevron, Devon Energy (shale pioneers now in EGS), Berkshire Hathaway (Warren Buffett), Bill Gates’ Breakthrough Energy Ventures, and government agencies (DOE, ARPA-E). Fervo Energy—the EGS pioneer—has secured massive funding and BLM approvals for projects like Cape Station in Utah (aiming for 2 gigawatts, enough to power a major city from <1 square mile). Whitney Tilson’s connections (including Wall Street legends like Bill Ackman and Joel Greenblatt who follow his work) make Commodity Supercycles your insider guide.

What do I get when I subscribe to Commodity Supercycles?

As a new member, you receive:

– 12 monthly issues packed with energy/resource recommendations and analysis.

Three exclusive special reports (free with your trial):

– Limitless Energy: Four Stocks That Could Power America for 30,000 Years (pure EGS plays).

– Water, Land, & Steel: Four “Pick and Shovel” Plays (infrastructure enablers).

– Backdoor Blue Chips (established giants dipping into EGS).

– Full model portfolio, archive access, and real-time updates.

Normally $499/year, but introductory trials offer big discounts with a 100% money-back guarantee in the first 30 days—no risk!

Is EGS really limitless and better than solar, wind, nuclear, or oil?

Yes—it’s virtually infinite (Earth’s core heat equals 30,000 nuclear plants running constantly), reliable baseload (no weather dependence or intermittency), zero emissions/waste, and deployable nationwide (near data centers, military bases, factories). Unlike nuclear (radioactive waste, long build times), solar/wind (intermittent, land-intensive), or fossil fuels (finite), EGS repurposes shale tech for fast scaling. Experts call it the “smokin’ hot trophy wife of the oil and gas industry”—even traditional energy firms love it.

Who is Whitney Tilson, and why subscribe to his Commodity Supercycles?

Whitney Tilson is a former hedge fund manager who built a $200M firm and tripled client money. He’s predicted major moves (2008 bottom on 60 Minutes, Netflix at $7.78, McDonald’s post-crash surge) and now edits Commodity Supercycles at Stansberry Research. His service focuses on energy/commodity supercycles, delivering actionable picks with strong past wins (e.g., 264% on Kaminak Gold, 339% on Silver Wheaton). Billionaires subscribe for his insights—join to get ahead of the EGS boom like early shale investors did.

What risks should I know about investing in EGS/geothermal stocks?

All investments carry risk; past performance doesn’t guarantee future results. EGS is emerging—projects like Fervo’s Cape Station are advancing rapidly (with 2026+ timelines), but drilling success, regulatory hurdles, or market shifts could impact outcomes. Whitney emphasizes thorough research via Commodity Supercycles’ deep analysis. The 30-day full refund lets you evaluate risk-free.

How does AI and data center demand tie into the EGS story?

AI’s massive energy needs (each data center uses small-city power) threaten shortages and blackouts. Nuclear takes 10+ years; EGS scales faster with existing rigs. That’s why Google, Microsoft, Meta, and Amazon are rushing into geothermal deals—driving stock surges in related plays (similar to 800% nuclear gains). Whitney Tilson positions EGS as the reliable, always-on solution to fuel AI’s golden era.

How do I get started and claim my free reports before it’s too late?

Click here for your special trial of Commodity Supercycles. Download the EGS reports instantly, explore the model portfolio, and see real-time updates. With the EGS revolution accelerating (government push, land auctions, AI demand), early action could deliver life-changing wealth. Subscribe risk-free today—America’s limitless energy future is calling!