Artificial intelligence has already transformed industries from healthcare to entertainment—but what if it could also predict the future of the stock market?

That’s exactly the idea behind TradeSmith’s AI Super Portfolio — a brand-new investing system that promises hedge-fund-level precision, built to forecast the future prices of over 2,300 stocks. And according to its creators, it’s about to signal a major move in the markets.

For you, investors curious about the next big thing in AI and finance, this new system is being positioned as a potential game-changer. But what exactly is it? How does it work? And most importantly—is it worth your time (and money)?

Let’s break down what TradeSmith’s AI Super Portfolio really is, who’s behind it, and what you can expect if you decide to plug into this “Super AI.”

>> TradeSmith’s Super AI Trading Event – Watch The Replay Here

>> Read Full The AI Super Portfolio Review: TradeSmith TimeGPT 5 Stocks

What Is the AI Super Portfolio?

The AI Super Portfolio is a curated selection of high-potential stocks powered by Super AI, designed to potentially quadruple your portfolio in just 12 months.

It is the culmination of TradeSmith’s Super AI technology. This portfolio harnesses the system’s ability to predict stock prices with 85% backtested accuracy, selecting a concentrated group of stocks from 2,334 options to maximize returns while minimizing risk.

Inspired by the 2023 ChatGPT boom, Keith Kaplan adapted advanced AI to analyze vast market datasets, identifying anomalies and high-probability trades that human analysts could never detect.

What Makes AI Super Portfolio Different?

The company positions the AI Super Portfolio as something that bridges two worlds: hedge-fund-level data analysis and everyday accessibility.

The hook is powerful:

“A powerful AI that can predict stock prices with hedge-fund precision — and it’s calling out a major market move as soon as this month.”

That’s the marketing promise. According to the event page, this system is expected to reveal an anomaly in the market — a mispricing opportunity that could potentially quadruple your portfolio using what the company calls a “rare investment vehicle.”

They even mention that a free stock pick will be revealed during the event.

For many retail investors—especially younger ones used to tools like Robinhood or Webull—this kind of “plug-and-play” AI might sound like the future of investing. But before we jump to conclusions, let’s explore who’s behind the curtain.

Who’s Behind TradeSmith’s AI Super Portfolio?

Keith Kaplan — CEO of TradeSmith

Keith Kaplan is the public face of the Super AI system. He’s the CEO of TradeSmith, a financial technology company that’s been around since 2005.

TradeSmith has been featured in The Economist, The Wall Street Journal, CNN, Forbes, and CNBC, and today it supports 134,000 investors in 86 countries, collectively tracking $29 billion in assets.

Kaplan isn’t new to this space. He’s known for developing algorithms that identify optimal buy and sell dates, as well as how to position portfolio weightings for better returns. In backtests, his algorithms reportedly outperformed many well-known Wall Street managers — including David Einhorn and John Paulson.

In one example shared during a previous live event, a participant’s $46,271 profit could have grown to $433,806 using Kaplan’s algorithm — nearly a 10X gain.

While past performance is never a guarantee of future results, the company uses stories like these to highlight Kaplan’s track record in developing technology-driven investing systems.

Now, he’s taking things “to a new level — using AI.

What Is the “Super AI Trading Event”?

The Super AI Trading Event is the official launch moment for the AI Super Portfolio. It’s scheduled for Wednesday, October 15 at 10 a.m. ET.

It’s a free, live online event where Keith Kaplan will introduce the new system, demonstrate how it works, and even reveal a free stock recommendation.

The company claims this new “Super AI” will expose a massive anomaly in the market that could help investors potentially quadruple their portfolios within the next 12 months.

To prepare attendees, TradeSmith offers several FREE resources before the event:

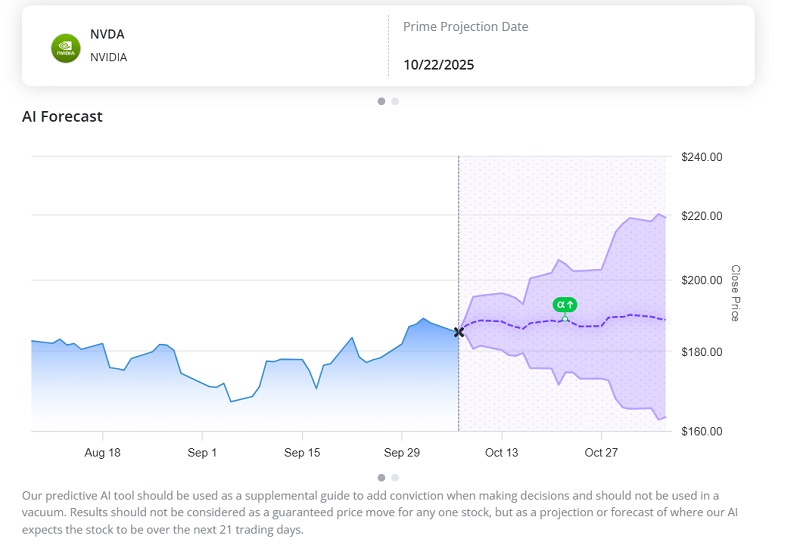

- Free access to the Super AI system, allowing users to type in any of 2,334 stocks or 60 ETFs to see predicted future prices, trading windows, and accuracy rates.

- Three prep videos explaining the system, its accuracy, and why it works—even during market crashes.

- A free report, “2 Stocks to Plug Into Our Super AI Right Now.”

For anyone interested in AI-driven investing, these pre-event materials are designed to both educate and entice.

What Does the Super AI System Actually Do?

The Super AI platform gives users the ability to:

- Type in any stock (from a list of 2,334) and see its future price trajectory.

- Hover over the chart to see predicted prices, potential upside, and historical accuracy rates.

- Use a chat feature to ask the AI which stocks have the highest potential upside, best projections for the next 7 days, and more.

The AI can even display optimal trading windows and accuracy percentages, so you can see how often it’s been right historically.

According to TradeSmith, this system is capable of pinpointing investment opportunities that could outperform the S&P 500 by up to 39-fold, based on a 5-year backtest.

That backtest also showed a 374% average gain on a model portfolio — supposedly through both bull and bear markets — using what they describe as a “rare investment vehicle” that only 1% of public companies represent.

What’s Included for Subscribers?

While the free event gives investors access to the Super AI platform for a limited time, the full version — the AI Super Portfolio — is positioned as a premium, “high-ticket” service.

Subscribers get:

- Access to Super AI forecasts for thousands of stocks and ETFs.

- Weekly curated recommendations

- Live updates and insights from the AI system as new anomalies appear.

- Special reports

- Ongoing access to Keith Kaplan’s portfolio insights and trading research.

The system itself, TradeSmith notes, is valued at $5,000 per year — though early event attendees can test it for free leading up to the October 15 launch.

How to Join the Super AI Trading Event

It’s a straightforward process:

1. Sign up for free using your email.

You’ll receive access to:

- The three-part video series introducing the Super AI.

- A link to the free AI tool to test forecasts on 2,334 stocks.

- The free report with two AI-flagged stocks.

2. Tune in live on October 15 at 10 a.m. ET.

Attendees are encouraged to log in 15 minutes early to test sound and video and to have pen and paper ready to take notes during the event.

TradeSmith’s Background: Who Are They?

Founded in 2005, TradeSmith began with its first major product, TradeStops, a tool that helped investors track portfolios using trailing stops (automated sell points). Over the years, the company evolved into a leading developer of risk management and portfolio analysis tools for individual investors.

Today, it offers a suite of AI-powered systems, newsletters, and data analytics, designed to help retail investors make professional-grade decisions.

As a subsidiary of MarketWise, TradeSmith emphasizes education, accessibility, and technology. Their mission is to give individuals the same level of insight and precision that hedge funds enjoy — without needing Wall Street credentials or connections.

Why Is This Launch Getting Attention?

Because TradeSmith isn’t just promising another market newsletter — they’re promising AI foresight.

The company claims that their “Super AI”:

- Can forecast stock price movements to the penny.

- Works during both bull and bear markets.

- Can turn 10 minutes of use per week into portfolio-changing gains.

These are big promises. The event materials reference past results where the AI would’ve generated 374% annual returns, beating the market by as much as 39-fold in backtests.

And while those numbers come with the usual disclaimers (“past performance doesn’t guarantee future results”), it’s easy to see why young investors — especially those interested in tech and automation — might be drawn to this idea.

Pros and Cons of the AI Super Portfolio

Pros

AI-Driven Precision:

Super AI claims 85%+ accuracy — far higher than most human-led analysis.

Accessible for Everyday Investors:

Instead of requiring Wall Street experience, the Super AI makes professional-grade data available to anyone with an internet connection.

Free Access Before Launch:

You can test the platform and view its predictions for free leading up to the event — a rare opportunity to “try before you buy.”

Actionable Insights:

You’re not just given data; you get specific forecasts, optimal trading windows, and even chat-driven insights on top stock opportunities.

Educational Materials:

The included videos and reports help new investors understand AI’s role in financial forecasting.

High Transparency About Process:

The presentation provides clear explanations about backtesting, data sources, and user access.

Cons

Extraordinary Claims:

An 85% accuracy rate and 374% average gains are eye-catching, but any experienced investor knows that real-world performance rarely matches perfect backtests.

Requires Discipline:

Even if the AI Super Portfolio system is accurate, consistent execution is key. The strategy involves active weekly trades, which may not fit every investor’s style.

Short-Term Focus Risk:

While rapid trades can capture short-term profits, they can also magnify losses during volatile periods.

Is the AI Super Portfolio Worth It?

For young investors, the appeal of TradeSmith’s AI Super Portfolio is clear. It blends the excitement of AI with the promise of hands-free investing.

If you’re someone who loves testing new financial tech, is comfortable with active trading, and wants to explore AI’s potential in forecasting markets— then attending the free October 15 event could be worthwhile.

However, it’s also important to approach it with realistic expectations. Predictive systems, no matter how advanced, are not crystal balls. Even at 85% accuracy, 15% of trades could go wrong — and that can make a big difference depending on your portfolio size and risk tolerance.

That said, the free trial access and educational materials make this a relatively low-risk opportunity to learn how AI tools can assist your investing decisions.

For many young investors, the value might lie less in chasing instant profits and more in understanding how AI is reshaping the financial landscape.

Final Thoughts

The TradeSmith AI Super Portfolio paints an exciting picture: a powerful artificial intelligence that can forecast market moves, identify hidden opportunities, and even help ordinary investors outperform Wall Street pros.

Keith Kaplan’s system is ambitious, data-heavy, and — at least in testing — remarkably successful. Whether those results hold up in the real world remains to be seen.

But one thing is undeniable: AI is already changing the rules of investing, and TradeSmith’s AI Super Portfolio represents one of the most ambitious attempts yet to make that technology available to everyone.

For young investors looking to get ahead of the next wave of innovation, this might just be one of the most talked-about launches of the year.

Frequently Asked Questions (FAQ)

What is the TradeSmith AI Super Portfolio?

It’s a new portfolio product powered by Super AI, an AI system that forecasts stock prices with reported 85%+ accuracy.

When does it launch?

The official launch is on Wednesday, October 15 at 10 a.m. ET, during the Super AI Trading Event.

How much does AI Super Portfolio cost?

The event and limited-time access to the AI system are FREE. The full subscription to AI Super Portfolio will be revealed at the event. Expect discounts during the official launch.

Who is Keith Kaplan?

He’s the CEO of TradeSmith, a financial tech company helping 134,000 investors manage $29 billion in assets using algorithmic tools.

How accurate is AI Super Portfolio?

TradeSmith claims 85%+ accuracy in backtests covering 2,334 stocks.

Is AI Super Portfolio suitable for beginners?

Yes, the materials are designed to be user-friendly. However, it’s best for investors comfortable with active trading.

What’s the biggest risk?

Relying too heavily on AI predictions without managing risk. Even with high accuracy, markets remain unpredictable.

Is it worth attending the event?

For investors interested in learning about AI-driven trading, the free event and trial access are definitely worth exploring.