The U.S. is on the brink of a seismic wealth shift – one driven by D.C., not Wall Street. Recently, insiders in Washington and the Pentagon have quietly assembled a list of “critical resource” companies they consider too vital to ignore. Now, thanks to resource legends Rick Rule and Nick Hodge, everyday investors finally have the chance to get in early. Their brand-new service, Underground Alpha, is debuting at The Stocks That Save America Summit, revealing the stocks America’s top officials are buying next.

The Stocks That Save America Summit: A Once-in-a-Lifetime Opportunity

On November 18, seven leading financial firms, including Stansberry Research, InvestorPlace, TradeSmith, and more, are hosting The Stocks That Save America Summit. This event addresses what may be the biggest market story of our era: the government’s direct investments in public companies, as a matter of national security.

Congress, the White House, and Pentagon are injecting capital, approving strategic permits, and acquiring stakes in U.S. firms that control the supply of rare earths, strategic minerals, and metals – essential for AI chips, EVs, advanced defense tech, and nuclear power. Recent moves have sent stocks soaring by hundreds – and even thousands – of percent.

Government’s Role in Commodity Markets vs. Wall Street

Federal Oversight & National Priorities:

While Wall Street is known for profit-seeking and trading, the U.S. government’s engagement in commodity markets is guided by security, stability, and national policy. Via agencies like the CFTC, federal directives shape the playing field—curbing speculation, promoting transparency, and ensuring that vital materials remain available for industry and defense.

Permanent Demand Creation:

Unlike Wall Street, government is not just a regulator—but a buyer and funder. Executive Orders, Pentagon contracts, and Congressional programs (like the CHIPS Act or mining fund proposals) send clear signals to private industry about which companies are considered “too critical to fail.” Long-term procurement deals and guaranteed purchases offer stability that speculative investors simply cannot match.

Wall Street Dynamics:

Wall Street provides liquidity, diversifies risk, and responds to government policy by deploying capital, launching ETFs, and building new financial products. But when policy shifts—such as the push for domestic sourcing due to geopolitical tension—capital flows shift quickly in response to government priorities.

Key Difference:

Today, government involvement means permanent baseline demand and “policy-of-last-resort” support. Wall Street may chase momentum, but federal funding creates it.

Profiles of Critical Minerals: Why Resource Stocks Matter Now

Rare Earth Elements (REEs):

Essential for motors, electronics, renewable energy, and advanced military systems. The U.S. is racing to build domestic extraction and refinement capacity to cut its dependency on China.

Lithium:

Already the backbone of the electric vehicle revolution and grid storage, lithium demand is soaring. Most supply is concentrated overseas; American projects are scaling rapidly thanks to new funds and expedited permits.

Cobalt:

Key to batteries for EVs and mobile devices. While 70% of current supply is from the Democratic Republic of Congo, U.S.-backed mining and recycling projects are gaining momentum as defense strategists aim to diversify sourcing.

Uranium:

The critical fuel for nuclear energy and national defense. Strategic grants and policy reform are supporting domestic mines and processing facilities to secure future supply.

Copper:

Indispensable for electrification, now in short supply thanks to the green energy transition. New mines, partnerships, and investment funds are directing capital to American copper projects for both infrastructure and renewable growth.

Each mineral is subject to direct government intervention, favoring U.S.-based firms with technology, permits, and proven supply chain capacity.

Analysis of Policy Directives, Supply Chain Reforms & Investment Funds

Promoting Resilient Supply Chains Act (2025):

This landmark policy directs federal agencies to assess vulnerabilities, map strategic resources, seek public input, and collaborate with industry to future-proof America’s supply chain. It sets the stage for regular Congressional updates and funding.

CHIPS Act (2022) & Related Directives:

The CHIPS Act has reshaped the semiconductor supply chain, but similar models are now rolling out for critical minerals—government money is targeting battery metals, uranium, copper, and rare earths at unprecedented scale.

Executive Orders & Defense Department Planning:

Recent Executive Orders have blocked hostile takeovers (especially from China), sped up federal permitting, and provided direct financial support to key resource sectors. Pentagon initiatives now secure multi-year procurement and government-backed demand, transforming the investment landscape from short-term speculative bets to strategic reserve building.

Federal Mining Fund:

With a proposed $5 billion federal mining fund and hundreds of billions expected from private investors, America’s resource sector is benefiting from tailwinds not seen since World War II. This flood of capital is swiftly re-rating stocks, creating overnight winners when government moves hit the wires.

Why Underground Alpha Picks Launches Today

Rick Rule and Nick Hodge aren’t just commentators; they’re dealmakers with decades of experience, hundreds of multi-bagger wins, and direct lines to the billionaires, defense insiders, and federal decision-makers reshaping the U.S. resource landscape.

Underground Alpha is their answer to the fast-moving window of opportunity:

-

Direct access to the informal “White House Buy List”

-

In-depth research on next-in-line mining and resource stocks

-

Strategies for entering before government and billionaire money hits

-

Monthly portfolio guidance for emerging and established resource winners

This service is unlike anything Wall Street offers, focusing on the companies the government is now forced to back as a matter of national security.

Why Washington Is Driving Parabolic Moves in Resource Stocks

America’s supply chains, critical for defense and tech, have become dangerously reliant on foreign countries—especially China. In response, Washington is moving billions into domestic resource firms to:

-

Secure rare earths and metals for AI, EVs, nuclear tech, and weaponry

-

Accelerate permit approvals for U.S.-based mining projects

-

Create a $5 billion federal mining fund, with Wall Street lining up hundreds of billions more

-

Prevent economic and military crises through strategic investment

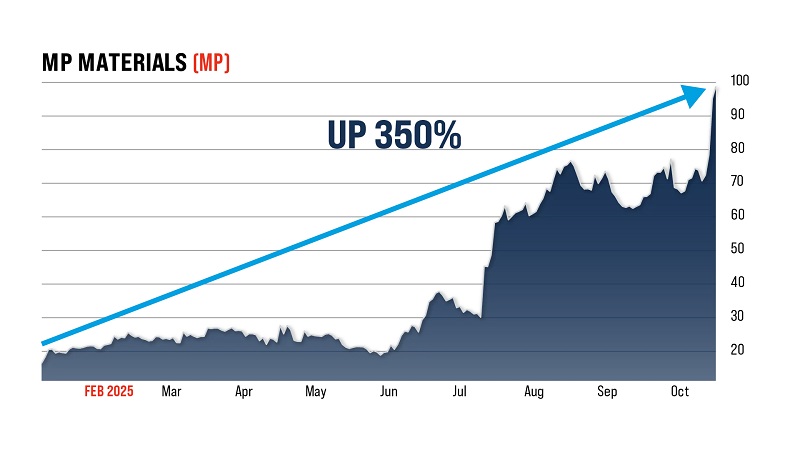

Stocks added to this unofficial “chosen list” can double overnight. MP Materials, Lithium Americas, and Trilogy Metals have already demonstrated extreme moves after Pentagon or White House investment.

What Underground Alpha Delivers

-

Exclusive Buy Alerts drawn from confidential government briefings, fast-tracked permits, and insider connections

-

Sector rotations and portfolio allocation models based on geopolitical momentum, supply chain urgency, and investment flows

-

Advanced analysis on tailwinds like Defense Department guarantees, Silicon Valley investments, and government-backed grants

Each pick is backed by Rule and Hodge’s track record—delivering opportunities long before they reach most mainstream research channels.

The Experts Behind the Service

Rick Rule:

-

50-year veteran, former CEO of Sprott ($50 billion manager)

-

Two 1,000x stock winners—Paladin and Equinox Gold

-

Adviser to top resource funds, factual insider to the D.C. supply chain revolution

Nick Hodge:

-

Founder of Daily Profit Cycle, energy and resource investing legend

-

Known for uncovering “off-limits” resource opportunities and sector-disrupting moves

-

Partnered with Rick Rule to launch Underground Alpha for Main Street investors

Together, they offer the market’s best chance to profit from America’s urgent resource push.

Case Studies: When Government Backs Stocks, Investors Win Big

-

MP Materials (MP): Pentagon buy-in, shares up 90% overnight, then 300%

-

Lithium Americas (LAC): White House nod, shares doubled in 24 hours

-

Trilogy Metals (TMQ): Government stake, shares tripled instantly

-

28 government-linked stocks have doubled this year, 10 up 500%+

Underground Alpha will track these moves and uncover the next wave before they hit mainstream headlines or institutional upgrades.

Step-by-Step Playbook: How to Use Underground Alpha

-

Attend The Stocks That Save America Summit for the first reveal

-

Subscribe for instant access to the curated shortlist, full buy list, and trade analysis

-

Check monthly portfolio updates and alerts for new catalysts

-

Follow insider moves, government priorities, and geopolitical signals

-

Use asset allocation models to maximize new bull market gains

Success comes from moving before the next government announcement, not chasing after.

What to Expect at the Stocks That Save America Summit

-

Full agenda run-through—urgent government moves, wealth transfer mechanics

-

Behind-the-scenes intelligence from Rick Rule and Nick Hodge

-

Real buy recommendations: name + ticker, provided LIVE on-air (free with registration)

-

Bonus report access, Q&A, and post-event replays for subscribers

Attendees will be first to receive information about Underground Alpha, top resource stocks, and positioning for America’s next bull run.

Conclusion: Don’t Miss Out on America’s Next Wealth Transfer

America’s future will be built on a secure supply chain—rare earths, metals, and strategic resources.

Rick Rule and Nick Hodge have opened the doors for everyday investors to follow the insiders, capitalizing before the government and Wall Street pour in.

Underground Alpha is your key to the full buy list, advanced analysis, and direct access to the stocks set to surge.

Register for The Stocks That Save America Summit today – and don’t watch the next bull market from the sidelines.

Key Questions Answered (FAQ)

What is the “White House Buy List”?

It’s a shortlist of U.S. resource companies considered essential for national security—getting capital, contracts, and priority status.

Why are resource stocks surging now?

Government, defense, and billionaire money is moving into firms supplying rare earths, metals, and strategic minerals—sectors now prioritized to counter foreign dominance.

How do I access Underground Alpha Picks and the government watchlist?

By subscribing during or after The Stocks That Save America Summit, you’ll get immediate access to exclusive research, buy alerts, and the full buy list.

Can anyone attend the event?

Yes, it’s free—simply register via the official website and join November 18 at 10 a.m. ET.

How is this different from other stock services?

Picks are based on direct government involvement, resource expertise, and defense priorities rarely seen in traditional financial research.